Dentsu Inc. (Tokyo: 4324; ISIN: JP3551520004; President & CEO: Tadashi Ishii; Head Office: Tokyo; Capital: 74,609.81 million yen) today released its calendar year 2015 annual report on advertising expenditures in Japan, including an estimated breakdown by medium and industry.

Based on Dentsu's survey, Japan's advertising expenditures for 2015 totaled 6,171.0 billion yen, an increase of 0.3% compared with the previous year's figure. Despite Japan's economic growth having ground to a halt in calendar 2015, overall spending on advertising posted year-on-year gains for a fourth consecutive year.

Overview of Advertising Expenditures during 2015

1. Advertising expenditures in 2015 had been expected to see positive effects resulting from such factors as the holding of Expo Milan 2015, substantial performance improvement by Japan's corporate sector and growth in household incomes. However, expectations were dampened by a fallback in demand following purchases made in the run-up to the increase in Japan's consumption tax rate in April 2014, such quadrennial events as the Sochi 2014 Olympic Games and the 2014 FIFA World Cup Brazil™, slowing economic growth in some areas of the global economy, and stagnant personal spending in Japan's domestic economy. Together, these factors led to advertising expenditure growth of 0.3% for the full calendar year.

2. Broken down by medium, advertising expenditures fell in Newspapers (down 6.2%), Magazines (down 2.3%), Radio (down 1.4%), and Television (down 1.2%; including both Terrestrial Television and Satellite Media-Related spending). As a result, overall spending in the traditional media posted a decline of 2.4%. In the Internet advertising market (up 10.2%), ads directed at smartphones, as well as video ads and ads using new advertising technologies, continued to expand, making the Internet medium the key driver for advertising expenditures overall. Although spending on Promotional Media decreased (down 0.9%), growth was recorded for Outdoor, Point-of-Purchase (POP) and Exhibitions/Screen Displays.

3. By industry category (for the traditional media, but excluding Satellite Media-Related spending), year-on-year spending rose in 6 of the 21 industry categories.

Major categories posting gains included Precision Instruments/Office Supplies (up 9.7% on increased placements for wristwatches and fountain pens); Information/Communications (up 5.1% on growth in advertising for online games and online stores); Energy/Materials/Machinery (up 4.1% on campaigns for gas companies and electric power companies); Foodstuffs (up 2.7% on increased placements for direct-marketed dietary supplements and health foods); and Transportation/Leisure (up 2.2% on increased advertising for membership sports clubs and theme parks).

Major categories posting declines included Hobbies/Sporting Goods (down 15.5% on decreased advertising for audio recordings and toys related to popular character franchises); Automobiles/Related Products (down 11.0% on weaker advertising for K-cars (engine displacement up to 660 cc), sedans and station wagons/hatchbacks); Beverages/Cigarettes (down 8.2% on lower placements for canned coffee and beer-like alcoholic beverages); Home Electric Appliances/AV Equipment (down 8.1% on a decline in placements for coffee makers, air purifiers and LCD televisions); Household Products (down 7.3% on decreased placements for specialized mattresses, furniture and functional frying pans and pots); and Real Estate/Housing Facilities (down 5.0% on reduced placements of general housing and rental housing ads).

● Outline of Advertising Expenditures by Medium

Advertising expenditures in the traditional media (including Satellite Media-Related spending) during the 2015 calendar year totaled 2,869.9 billion yen, down 2.4% compared with the previous year. Spending in Television (including both Terrestrial Television and Satellite Media-Related advertising) declined 1.2%.

Spending on Internet advertising reached 1,159.4 billion yen (up 10.2%), maintaining a robust double-digit growth rate. Promotional Media recorded a 0.9% spending decrease compared with the previous year's amount, to 2,141.7 billion yen.

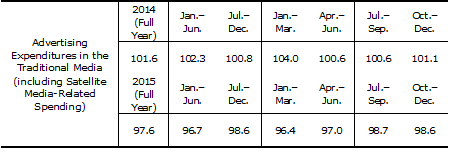

● Quarterly Breakdown of Growth in Advertising Expenditures in the Traditional Media in 2015

A quarterly breakdown of advertising expenditures in the traditional media (including Satellite Media-Related spending) shows that all four quarters recorded a decline, albeit the rate of contraction was smaller starting in July.

● Outline of Advertising Expenditures by Industry (21 Categories, Traditional Media Only, Excluding Satellite Media-Related Spending)

Advertising expenditures increased in 6 of the 21 industry categories surveyed during 2015, and declined in 15 categories. (The 2014 survey shows that expenditures were higher in 14 of the 21 industry categories, but lower in 7 categories.)

Categories posting gains were Precision Instruments/Office Supplies (up 9.7%) on increased placements for wristwatches and fountain pens; Information/Communications (up 5.1%), driven by ad placements for online games and online stores; Energy/Materials/Machinery (up 4.1%) on stronger demand for campaigns by gas companies and electric power companies; Foodstuffs (up 2.7%) on increased placements for direct-marketed dietary supplements and health foods; Transportation/Leisure (up 2.2%) on increased advertising for membership sports clubs and theme parks; and Food Services/Other Services (up 0.9%) on higher spending by restaurants, as well as door-to-door delivery and moving services.

Expenditures declined in the following 15 industry categories: Hobbies/Sporting Goods (down 15.5%) on decreased advertising for audio recordings and toys related to popular character franchises; Automobiles/Related Products (down 11.0%) on weaker advertising for K-cars (engine displacement up to 660 cc), sedans and station wagons/hatchbacks; Beverages/Cigarettes (down 8.2%) on lower placements for canned coffee and beer-like alcoholic beverages; Home Electric Appliances/AV Equipment (down 8.1%) due to decreases in ads for coffee makers, air purifiers and LCD televisions; Household Products (down 7.3%) on decreased placements for specialized mattresses, furniture and functional frying pans and pots; Real Estate/Housing Facilities (down 5.0%) on reduced placements of general housing and rental housing ads; Education/Medical Services/Religion (down 4.9%) on fewer placements for schools, as well as vocational and other educational institutions; Cosmetics/Toiletries (down 3.8%) on reduced ads for direct-marketed cosmetic lines for women, as well as for shampoos and conditioners; Publications (down 3.2%) on fewer placements related to language-study materials, and general weekly magazines; Classified Ads/Others (down 3.0%) on decreased demand for temporary recruitment ads; Finance/Insurance (down 2.8%) on lower placements related to direct-marketed health insurance products, NISA and inheritance-related products, as well as credit cards; Apparel/Fashion, Accessories/Personal Items (down 2.8%) on reduced placements for jewelry and accessories, women's clothing and functional innerwear; Government/Organizations (down 2.5%) on a decrease in ad placements by political parties and organizations; Pharmaceuticals/Medical Supplies (down 2.3%) on reduced advertising for intestinal medicines, supporters and contact lenses; and Distribution/Retailing (down 2.0%) on decreased placements relating to direct marketing businesses.

About the Dentsu Group

Dentsu is the world's largest advertising agency brand. Led by Dentsu Inc. (Tokyo: 4324; ISIN: JP3551520004), a company with a history of 114 years of innovation, the Dentsu Group provides a comprehensive range of client-centric brand, integrated communications, media and digital services through its nine global network brands--Carat, Dentsu, Dentsu media, iProspect, Isobar, mcgarrybowen, MKTG, Posterscope and Vizeum--as well as through its specialist/multi-market brands including Amnet, Amplifi, Data2Decisions, Mitchell (PR) and 360i.

The Dentsu Group has a strong presence in over 140 countries across five continents, and employs more than 47,000 dedicated professionals. Dentsu Aegis Network Ltd., its global business headquarters in London, oversees Dentsu's agency operations outside of Japan. The Group is also active in the production and marketing of sports and entertainment content on a global scale.

www.dentsu.com

# # # # #