Dentsu Inc. (Tokyo: 4324; ISIN: JP3551520004; President & CEO: Toshihiro Yamamoto; Head Office: Tokyo; Capital: 74,609.81 million yen) convened a meeting of its Board of Directors today and decided to execute business restructuring in seven markets of the international business* and to revise the latest forecast of financial results for the fiscal year ending December 31, 2019, which we announced on August 7, 2019.

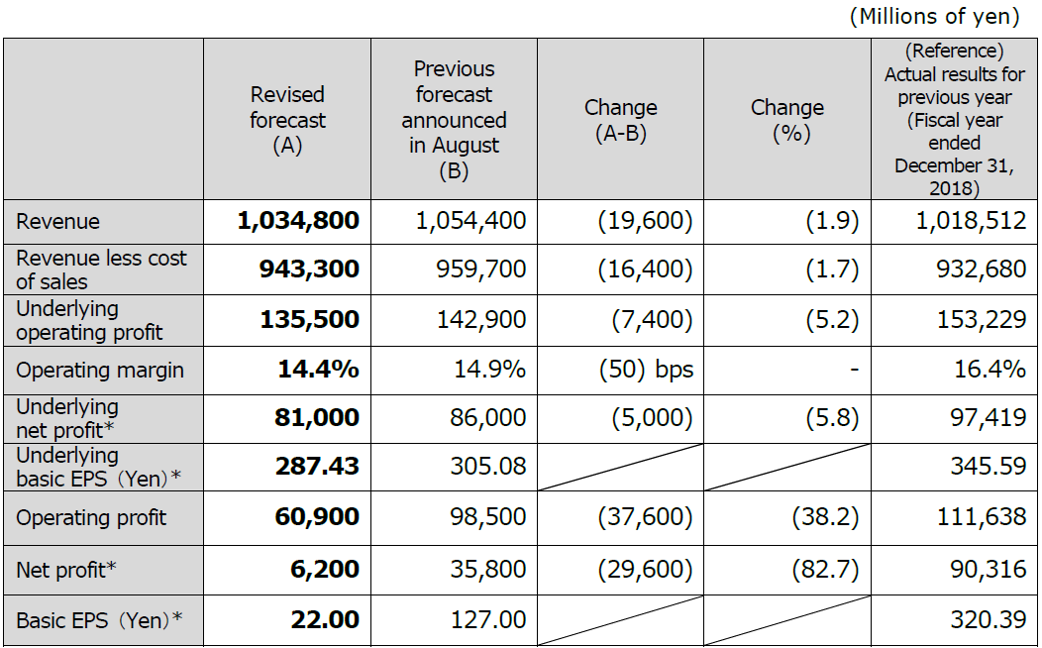

1. Changes to the Forecast of Consolidated Financial Results for the Fiscal Year Ending December 31, 2019 (IFRS)

*Attributable to owners of the parent

Notes:

Underlying operating profit: KPI to measure recurring business performance which is calculated as operating profit added with amortization of M&A related intangible assets, acquisition costs, share-based compensation expenses related to acquired companies and one-off items such as impairment loss and gain/loss on sales of non-current assets.

Operating margin: Underlying operating profit divided by revenue less cost of sales.

Underlying net profit (attributable to owners of the parent): KPI to measure recurring net profit attributable to the owners of the parent which is calculated as net profit added with adjustment items related to operating profit, reevaluation of earn-out liabilities/M&A related put-option liabilities, tax-related, NCI profit-related and other one-off items.

2. Reason for Changes to the Forecast of Consolidated Financial Results for the Fiscal Year Ending December 31, 2019 (IFRS)

Within the international business, there are a small number of large, complex and challenged markets that have reported ongoing underperformance over recent quarters. This has continued into the fourth quarter, resulting in a downward revision to our full year performance expectations. In order to future-proof the business, a number of planned strategic initiatives are being introduced in these markets to enable us to deliver sustainable growth in FY2020 and beyond. This restructuring will accelerate the implementation of the new business model and deliver improvements and efficiencies for our business and our clients.

The initiatives are confined to the seven markets: Australia, Brazil, China, France, Germany, Singapore (including regional headquarters) and the UK (including global headquarters of the international business). We remain committed to these markets to enable their long-term success but must ensure they are structured appropriately to drive operating margin improvements, deliver revenue growth, and achieve a better service for our clients and experience for our people.

The restructuring will result in an approximate 11% reduction of the total headcount in these markets, subject to local regulations, representing a reduction of 3% of the total headcount of the international business, as well as property rationalization and other related impacts. The estimated total cost is approximately GBP 179 million (JPY 24.8 billion). GBP 143 million (JPY 19.8 billion) will be recognized in the fiscal year ending December 31, 2019 and the remainder will be recognized in the fiscal year ending December 31, 2020. More than GBP 100 million (JPY 13.8 billion) of headcount related costs are expected to be saved on an annual basis.

In order to ensure our services are market leading and globally consistent, the structure of the international business will be simplified into three Lines of Business: Creative, CRM and Media.

These lines of business have been designed around client needs and will ensure we are set up to help clients win, keep and grow their best customers--by being data-driven, tech-enabled and idea-led. This will accelerate our ability to deliver integrated solutions to our clients and ensure our services are easier to navigate and set up for success in the mid-long term.

Regarding the Japan business, its performance has been in line with our expectations. There are no changes to the Japan business forecasts announced on August 7, 2019.

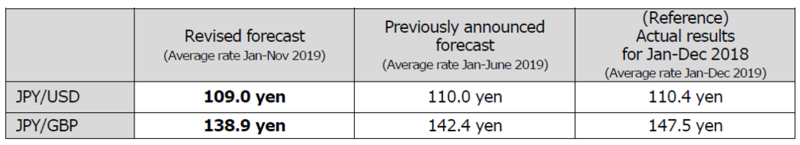

(Reference) Currency Exchange Rate

#####

* Dentsu operates businesses in over 145 countries and regions as well as in Japan.

Disclaimer

The forecasts of consolidated revenue/profit and non-consolidated net sales/profit provided in this document have been calculated based on judgments and assumptions made using currently available information such as industry trends and client circumstances. Therefore, actual results may differ from the forecasts due to uncertain elements inherent in the forecasts as well as other factors including changes in the domestic or overseas economic conditions of business operations going forward.