Over 40% of respondents recognized the term ethical consumption, but putting it into practice requires greater public awareness and promotion

Dentsu Inc. (Head Office: Minato-ku, Tokyo; President & CEO: Norihiro Kuretani) announced today that its New Social Design Engine, an interdivisional team engaged in socially conscious communication planning, has conducted a consumption survey. The Ethical Consumption* Survey 2022 was carried out nationwide, targeting 2,500 men and women, ranging from teenagers to people in their 70s.

The survey measured consumers' awareness of, empathy with, and willingness to engage in ethical consumption, as well as their expectations concerning 11 different categories of industries/products and services: food, daily necessities, apparel, cosmetics and beauty products, housing, automobiles, furniture, home appliances, energy, financial services, and travel services.

Trends in consumer awareness and related issues were examined by comparing results of the previous survey conducted in November 2020. The key findings of the survey are presented below.

* Consumption behavior of individual consumers who consider the resolution of social issues and support businesses that address social issues.

Key Survey Findings

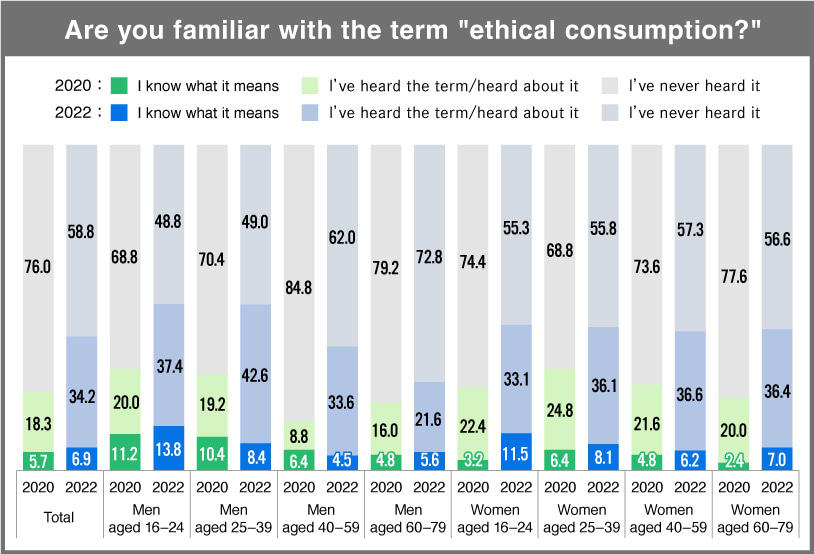

1. The term ethical consumption was familiar to 41.1% of the respondents, up 17.1 percentage points compared from the previous survey. Respondents who fully understood the term's meaning grew only marginally, however, indicating that the public requires further education.

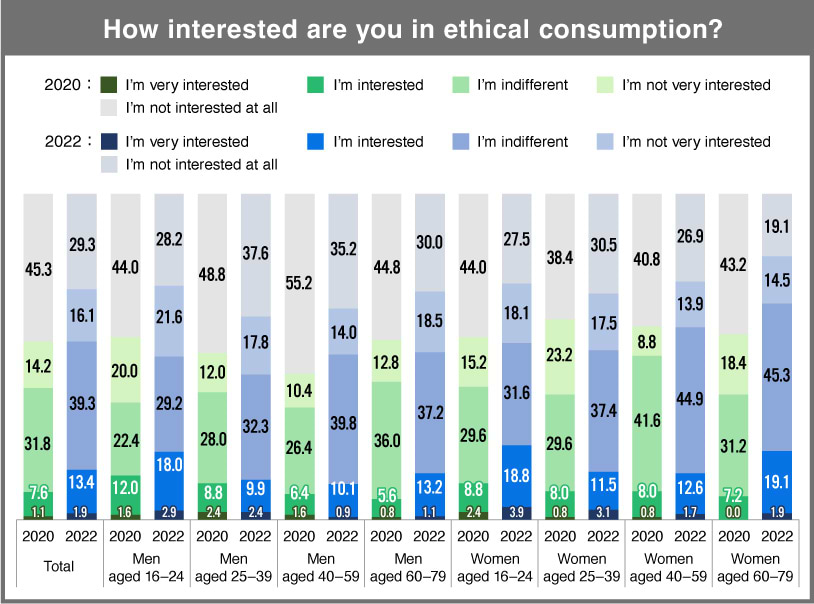

2. Interest in ethical consumption was expressed by 15.3% of the respondents, while those expressing indifference increased across all age groups. Nevertheless, among respondents who read and understood an explanation of ethical consumption in one section of the survey, 43.9% of them expressed a desire to engage in ethical consumption. Thus, it is necessary to create opportunities for learning about ethical consumption, especially for members of Generation Z, as this age group expressed high levels of interest.

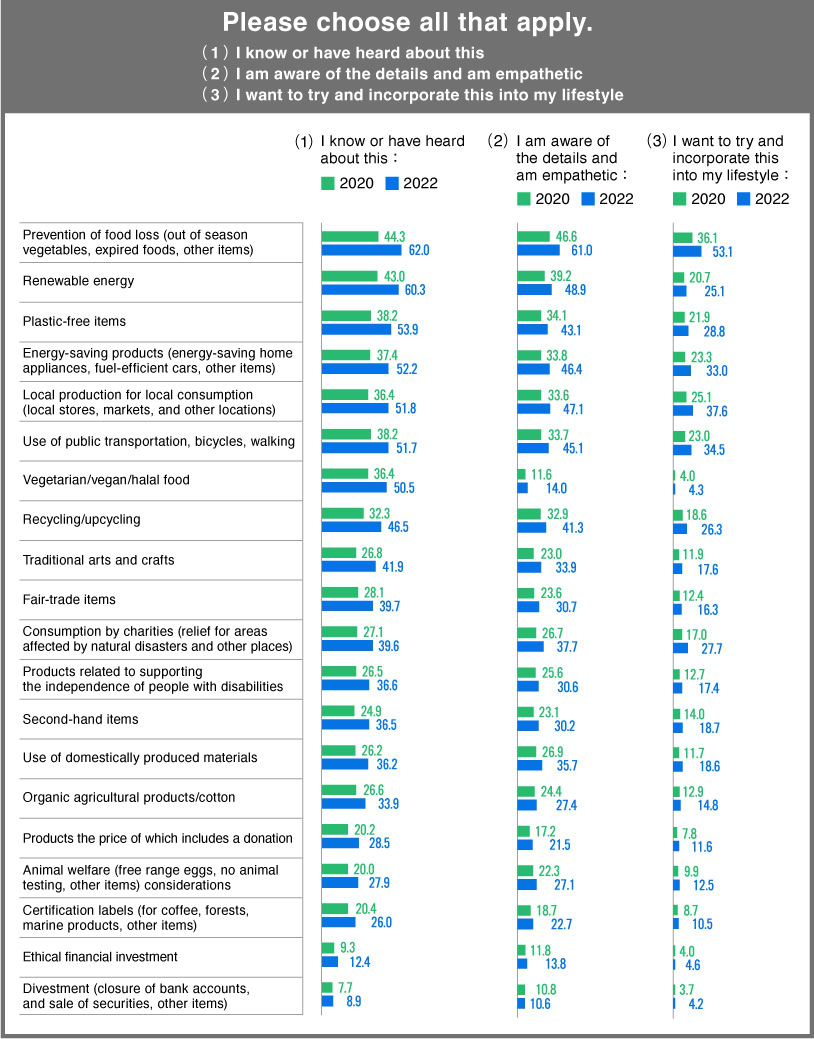

3. As in the last survey, the prevention of food loss was the category of ethical consumption concerning which respondents indicated the highest levels of awareness, empathy, and willingness to engage. High awareness of, but low empathy with, eating vegetarian/vegan/halal food indicates there is a need to increase opportunities for people to experience and learn about this type of consumption. Strong empathy with, but low willingness to engage in, the use of renewable energy suggests the need to lower the hurdles for adopting this source of energy.

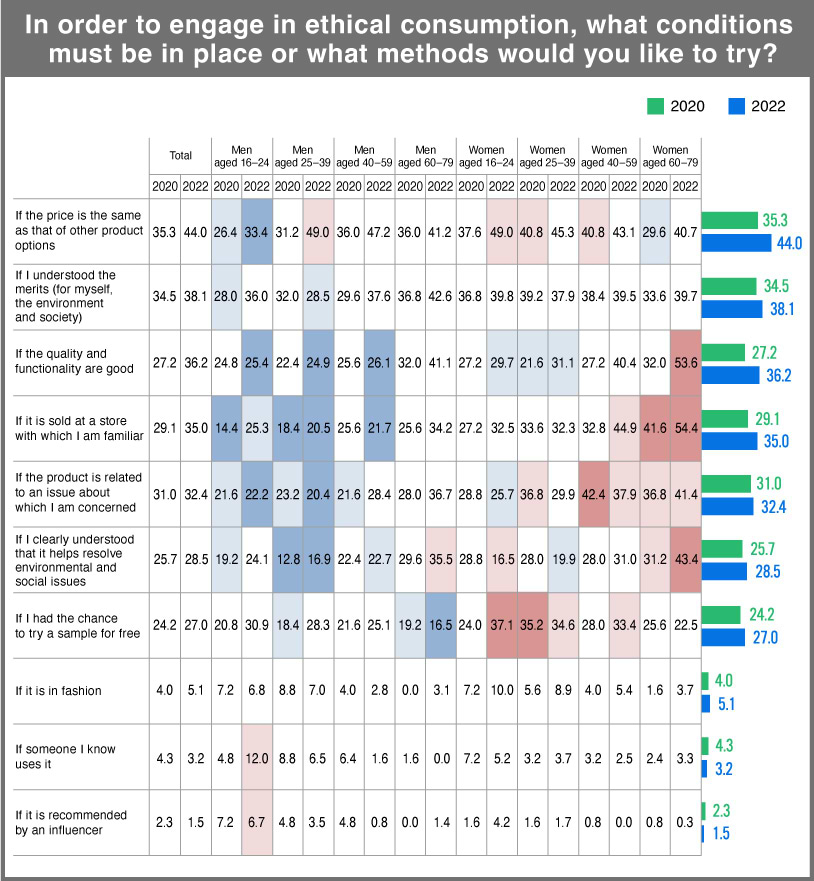

4. As in the survey before, prices similar to those of other product options and an understanding of product merits were most important when it came to interesting respondents in making ethical purchases. The increased importance placed on the quality and functionality of products, as well as their availability at familiar stores, reflect the intention of the respondents to maintain their quality of life and ensure convenience.

5. Compared with the previous survey, respondents were more interested in ethical purchases of Home Appliances and non-durable goods like Food and Daily Necessities, but less interested in purchases of Energy and durable goods like Automobiles and Housing. Survey scores were higher for categories for which respondents could easily imagine the relationship between ethical consumption and the respective industry, as well as how one's use of the products and services contributes to solving societal and environmental issues.

6. As in the last survey, food topped the list of industries that respondents believed are promoting ethical consumption. The gap between these efforts and expectations to do more in the future was widest for financial services. The intention to ethically consume energy increased the most, despite many consumers having had no past experience in this area of consumption. Opportunities for consumers to easily make such purchases are urgently needed.

Details of Findings

(1) Some 41.1% of the respondents were familiar with the term ethical consumption, up 17.1 percentage points from the previous survey. The number of respondents who indicated they fully understood the term's meaning, however, grew only marginally, reflecting the need to better educate the public.

● In response to the question regarding familiarity with the term ethical consumption, 41.1% of respondents answered either "I know what it means" or "I've heard the term/heard about it." This greatly exceeded the result of 24.0% in the previous survey.

● By age group and gender, the recognition rate was highest among men aged 16-24 (51.2%) and 25-39 (51.0%), and lowest among men aged 60-79 (27.2%).

● The percentage of all respondents who answered "I've heard the term/heard about it" was 34.2%, up from 18.3% in the previous survey. However, the percentage of those who answered "I know what it means," did not increase significantly. This suggests that, while a growing number of people have come across the term in media reports and news articles, it is still imperfectly understood across Japanese society. (Graph 1, below.)

Graph 1. Ethical Consumption Term Recognition

(2) Interest in ethical consumption was expressed by 15.3% of respondents, while those expressing indifference increased across all age groups. Nevertheless, among respondents who read and understood an explanation of ethical consumption in one section of the survey, 43.9% of them expressed a desire to consume ethically. Thus, it is necessary to create opportunities for learning about ethical consumption, especially for members of Generation Z, as this age group expressed high levels of interest.

● In response to the question about interest in ethical consumption, 15.3% of the respondents answered either "I'm very interested" or "I'm interested." Although this is 6.6 percentage points higher than the ratio in the previous survey, the result remains relatively low. As in the last survey, interest was highest among women aged 16-24 (22.7%) and men aged 16-24 (20.9%), the age group corresponding to Generation Z. The percentage of all respondents answering "I'm not interested at all" was 29.3%, 16.0 percentage points below the previous survey's figure. (Graph 2, below)

● Despite the results above, when asked about their desire to consume ethically on a regular basis, among respondents who read and understood an explanation of ethical consumption in one section of the survey,43.9% of them answered either "I definitely want to/I already do" or "I'm interested in trying." This suggests that that, were ethical consumption more widely understood, relevant behavior could be expected to follow. (Graph 3, below.)

Graph 2. Interest in Ethical Consumption

Graph 3. Willingness to Engage in Ethical Consumption

(3) As in the previous survey, the prevention of food loss was the category of ethical consumption concerning which respondents indicated the highest levels of awareness, empathy, and willingness to engage. High awareness of, but low empathy with, eating vegetarian/vegan/halal food indicated the need to increase opportunities for experiencing and learning about this type of consumption. Strong empathy with, but low willingness to engage in, the use of renewable energy suggests the need to lower the hurdles for adopting this source of energy.

● The survey includes questions about 20 categories of ethical consumption. Among them, respondents were most aware of the prevention of food loss (62.0%) and the use of renewable energy (60.3%). While these two categories also topped the 2020 survey, the results were over 17 percentage points higher for each category in 2022. Respondents were least aware of ethical financial investment (12.4%) and divestment (8.9%), with results largely unchanged from the previous survey.

● Respondents indicated the highest levels of empathy with the prevention of food loss (61.0%), the use of renewable energy (48.9%), and local production for local consumption (47.1%). Their willingness to engage in ethical consumption was highest for prevention of food loss (53.1%) and local production for local consumption (37.6%).

● Comparing responses for awareness of, and empathy with, the 20 categories of ethical consumption, the widest gap between the results was for eating vegetarian/vegan/halal food. When looking at the answers to questions regarding the use of renewable energy, the widest gap is between respondents who indicated they had empathy with use of this energy and those who indicated they were willing to engage in its use. This suggests that more opportunities should be created to encourage consumers to engage in ethical consumption. (Graph 4, below.)

Graph 4. Awareness, Empathy, Intention to Engage as Related to Ethical Consumption

(4) As in the last survey, prices similar to those of other product options and an understanding of product merits were most important when it came to interesting respondents in making ethical purchases. The increased importance placed on the quality and functionality of products, as well as their availability at familiar stores reflect the intention of respondents to maintain their quality of life and ensure convenience.

● The top answers given by respondents to the question regarding the conditions that needed to be in place in order for them to purchase an ethical product were "if the price is the same as that of other product options" (44.0%), "if I understand the product's merits (for myself, the environment, and society)" (38.1%), "if the product quality and functionality are good" (36.2%), and "if the product is sold at a store with which I am familiar" (35.0%). (Graph 5, below.)

● The results suggest that consumers do not want to purchase inferior products or compromise their quality of life in order to consume ethically. Thus, as long as an ethical product offers good value for money in terms of durability and long-term benefits, and this is advertised to consumers, the prospects are good for increasing ethical purchases.

Graph 5. Conditions Required to Engage in Ethical Consumption

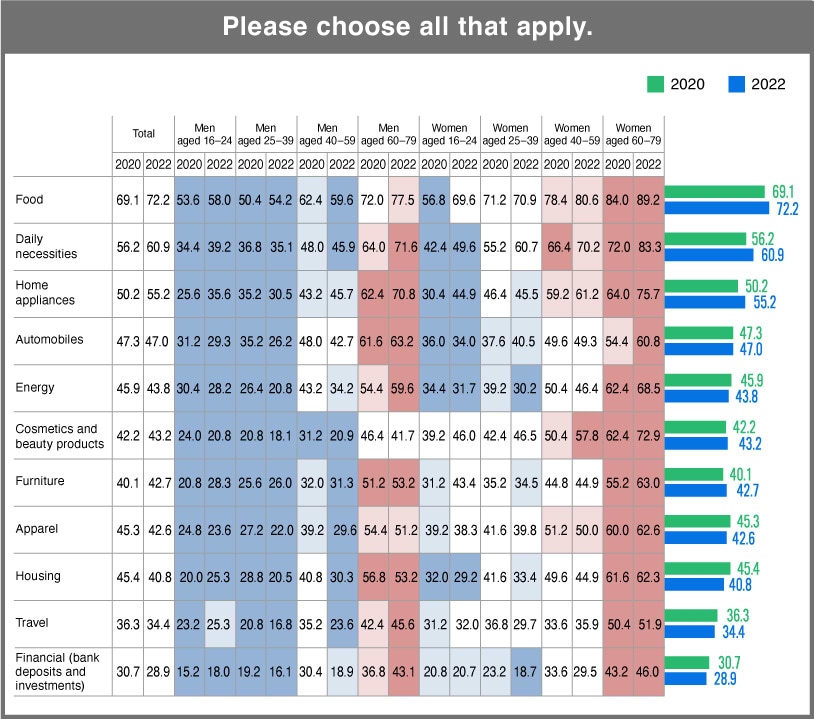

(5) Compared with the previous survey, respondents were more interested in ethical purchases of Home Appliances and non-durable goods like Food and Daily Necessities, but less interested in purchases of Energy and durable goods like Automobiles and Housing. Survey scores were higher for categories for which respondents could easily imagine the relationship between ethical consumption and the respective industry, as well as how one's use of the products and services contributes to solving societal and environmental issues.

● In response to a question asking in which categories of products and services respondents are most interested in making ethical purchases, they chose, in descending order, food, daily necessities, home appliances, automobiles, energy, cosmetics and beauty products, furniture, apparel, housing, travel services, and financial services. (Graph 6, below.)

● Compared with the previous survey, results increased for non-durable goods that people use on a daily basis. Specifically, this means food, daily necessities. The results for apparel, however, decreased. In contrast, results decreased for durable goods, such as automobiles and housing.

● Consumers seem more likely to make ethical purchases of non-durable goods because it is easy to identify with the items, while the ethical significance of such actions is clear. Recognizing the ethical significance and relevance of durable goods, however, can be difficult for some consumers. Therefore, efforts are needed to clearly explain and promote the relevance and impact of the ethical consumption of the items, such as their ability to reduce environmental burdens.

Graph 6. Ethical Consumption Purchase Intention by Industry

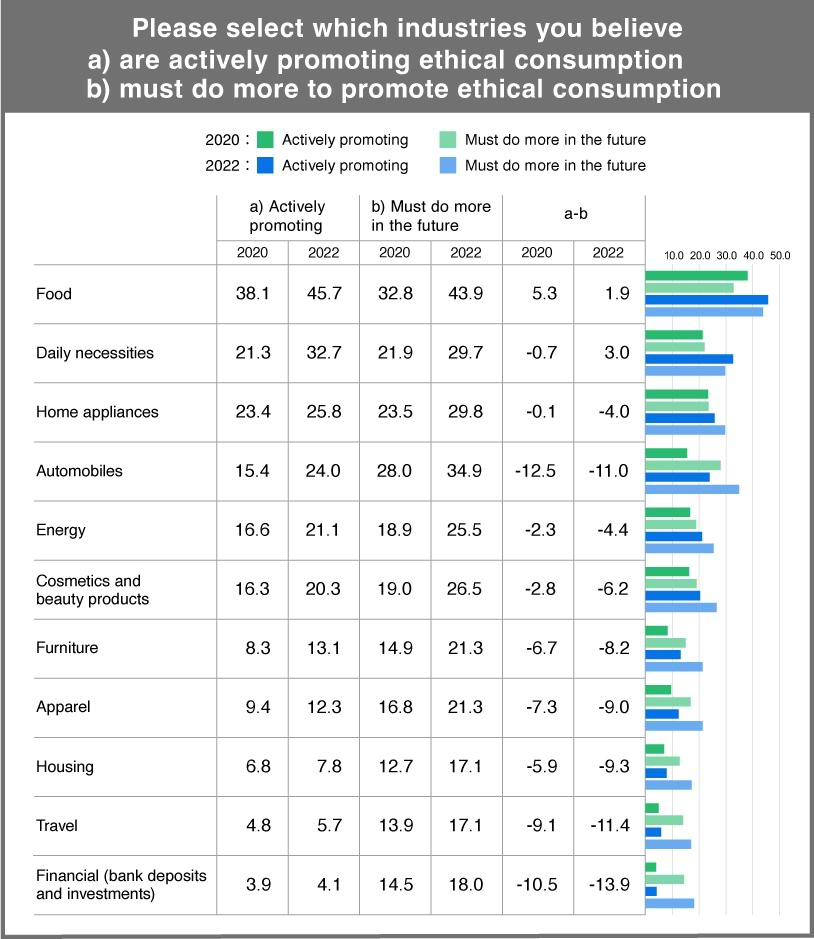

(6) As in the previous survey, food topped the list of industries that respondents believe are actively promoting ethical consumption. The gap between these efforts and expectations to do more in the future was widest for financial services. The intention to ethically consume energy increased the most, despite many consumers having no experience. Opportunities for consumers to easily make such ethical purchases are urgently needed.

● In response to a survey question regarding which industries are actively promoting ethical consumption, respondents chose, in descending order, food, daily necessities, automobiles, and energy. The results for food (45.7%) and daily necessities (32.7%) increased dramatically compared with the previous survey, suggesting that, besides individual companies, these industries as a whole have been educating consumers about their efforts to promote ethical consumption.

● In other industry categories, however, wide gaps can be seen between responses to this question and a question concerning which industries must do more to promote ethical consumption. The gaps were widest for financial services, travel services, and energy. A wide gap for energy was also found in the previous survey. Companies in this industry, in particular, need to step up their efforts to both promote ethical consumption and educate consumers about their industry-wide endeavors. (Graph 7, below.)

● Among categories of products and services that have been ethically purchased by respondents, those most commonly bought were, in descending order, food, daily necessities, and apparel. Further, among the categories of products and services in which respondents indicated they intended to make ethical purchases, food, daily necessities, and energy topped the list, in that order. Comparing products and services that respondents intended to purchase, despite never having done so before, the widest gaps were for energy, furniture, and travel services. Compared with the previous survey, the intention to ethically consume energy increased 31.7 percentage points, the highest jump of any category. (Graph 8, below.)

Graph 7. Industries Seen Actively Promoting Ethical Consumption, Expected to Do More

Graph 8. Ethical Consumption Purchase Experience/Purchase Intention, by Industry

Outline of Ethical Consumption Awareness Survey 2022

#####

Contact

Media-related inquiries:

Corporate Communications Office, Dentsu Inc.

Email: global.communications@dentsu.co.jp

Survey-related inquiries:

New Social Design Engine, Dentsu Inc.

Email: ethical@dentsu.co.jp