--Detailed analysis of spending in 2022 and the forecast for 2023, jointly carried out by Dentsu, CCI, D2C, Dentsu Digital, and Septeni Holdings--

Dentsu Inc. (Dentsu), CARTA COMMUNICATIONS Inc. (CCI), D2C Inc. (D2C), Dentsu Digital Inc. (Dentsu Digital), and Septeni Holdings Co., Ltd. (Septeni Holdings), have released a survey titled "2022 Advertising Expenditures in Japan: Detailed Analysis of Expenditures on Internet Advertising Media." The survey analyzes the results of "2022 Advertising Expenditures in Japan," published by Dentsu on February 24, 2023, and further breaks down data on Internet advertising media spending. The analysis presents data based on such variables as ad category and transaction method. It also includes forecasts for 2023.

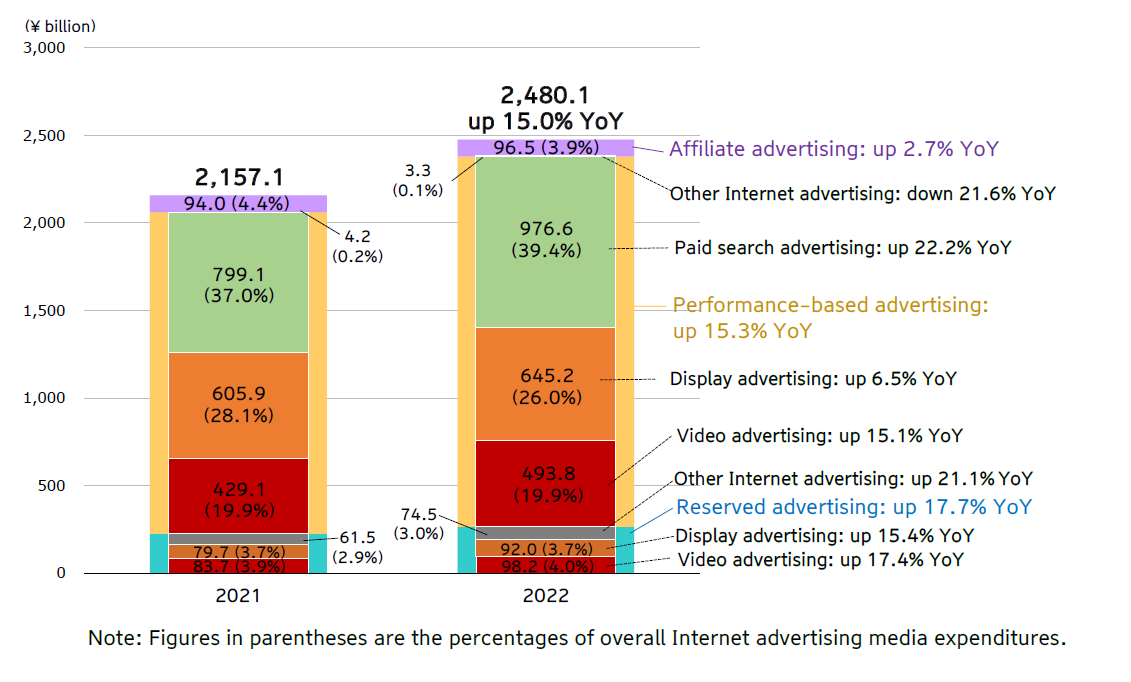

In 2022, advertising expenditures in Japan totaled 7,102.1 billion yen (up 4.4% year on year). Despite various domestic and international factors, including the rebound in COVID-19 infections in Japan, the war in Ukraine, and steeply rising commodity prices, advertising expenditures reached the highest level since estimates began in 1947. Internet advertising expenditures maintained their high rate of growth amid the ongoing digitization of society, reaching 3,091.2 billion yen (up 14.3% year on year), accounting for 43.5% of total advertising expenditures in Japan. Furthermore, excluding Internet advertising production costs and advertising expenditures for Merchandise-related EC Platforms, Internet advertising media expenditures amounted to 2,480.1 billion yen (up 15.0% year on year) due to growth in performance-based advertising, including paid search advertising and video advertising.

Key points of the "2022 Advertising Expenditures in Japan: Detailed Analysis of Expenditures on Internet Advertising Media" follow.

1. Paid search advertising rose to 976.6 billion yen, up a substantial 22.2% year on year.

By ad category, paid search advertising grew a considerable 22.2% year on year, accounting for 39.4% of Internet advertising media expenditures.

2. Performance-based advertising reached 2,118.9 billion yen, exceeding 2,000 billion yen for the first time since estimates began.

By transaction method, performance-based advertising recorded double-digit growth of 15.3% year on year, accounting for 85.4% of Internet advertising media expenditures. Reserved advertising rose 17.7% and affiliate advertising 2.7%, both methods achieving year on year growth.

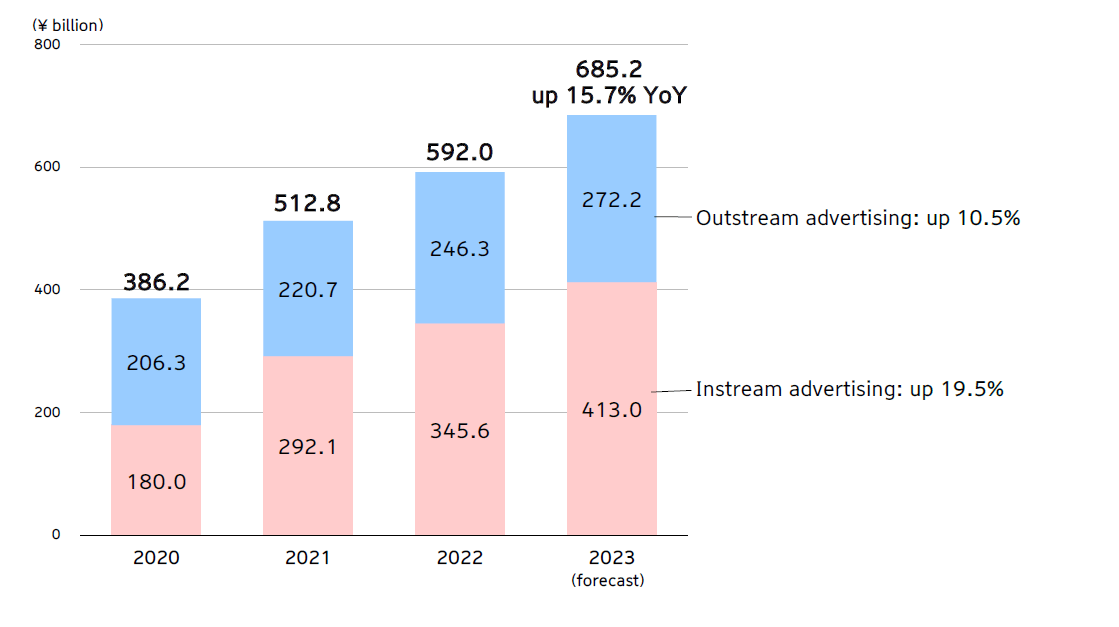

3. Video advertisements amounted to 592.0 billion yen.

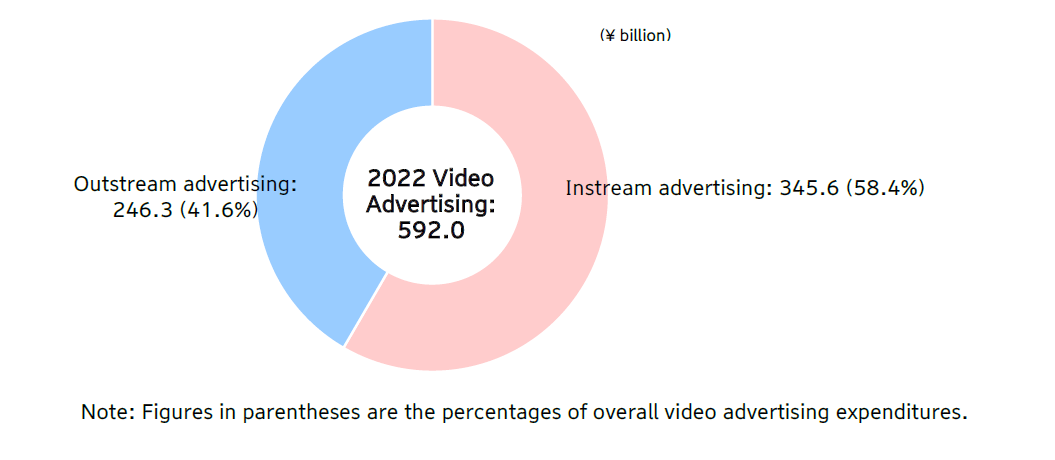

Video advertisements achieved double-digit year-on-year growth of 15.4%, of which instream advertising amounted to 345.6 billion yen, accounting for 58.4% of the video advertisement total.

In 2023, video advertising is forecast to achieve a high growth rate of 15.7% year on year to reach 685.2 billion yen.

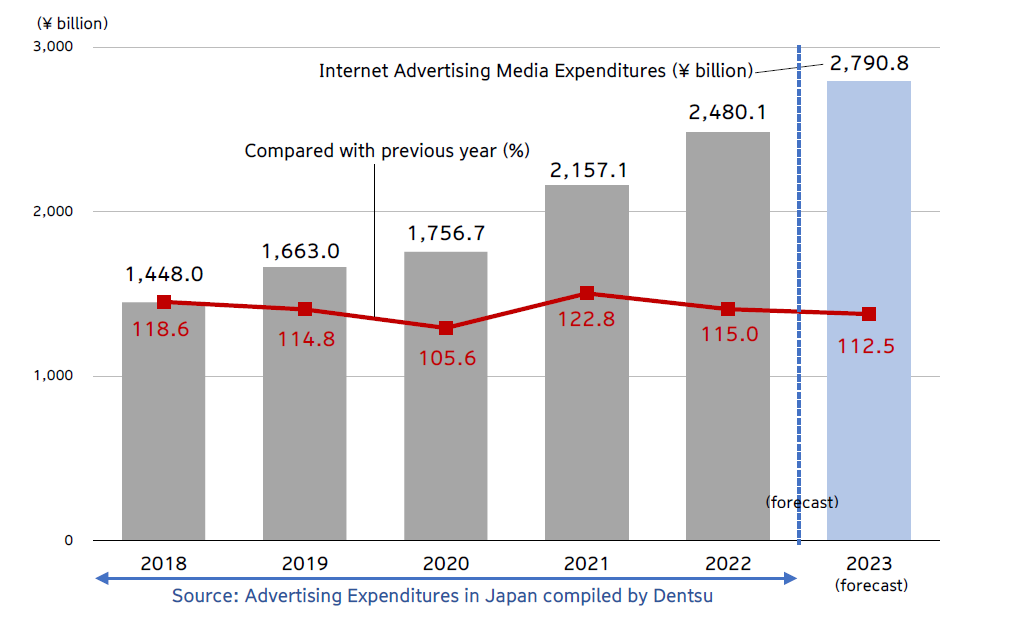

4. In 2023, Internet advertising media expenditures are forecast to reach 2,790.8 billion yen.

Internet advertising media expenditures are expected to remain firm in 2023, increasing 12.5% year on year to 2,790.8 billion yen.

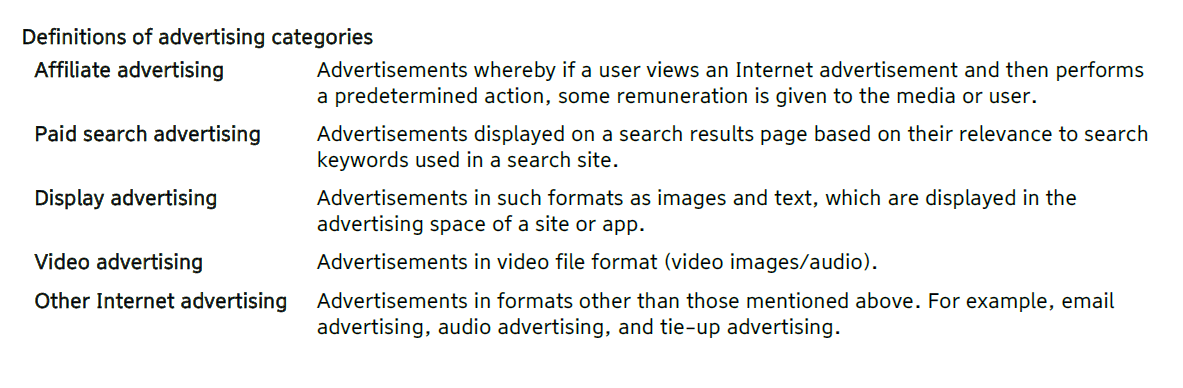

Expenditures on Internet Advertising Media: Breakdown by Advertising Category

―Paid search advertising amounted to 976.6 billion yen, having grown a substantial 22.2% year on year.―

In 2022, Internet advertising media expenditures in Japan increased 15.0% year on year to 2,480.1 billion yen (according to "2022 Advertising Expenditures in Japan," published by Dentsu). By ad type, paid search advertising increased 22.2% year on year to 976.6 billion yen, accounting for 39.4% of total Internet advertising media expenditures. Video advertisements grew 15.4% year on year to 592.0 billion yen, accounting for 23.9% of the total. (Graph 1)

Graph 1. Expenditures on Internet Advertising Media: Breakdown by Advertising Category

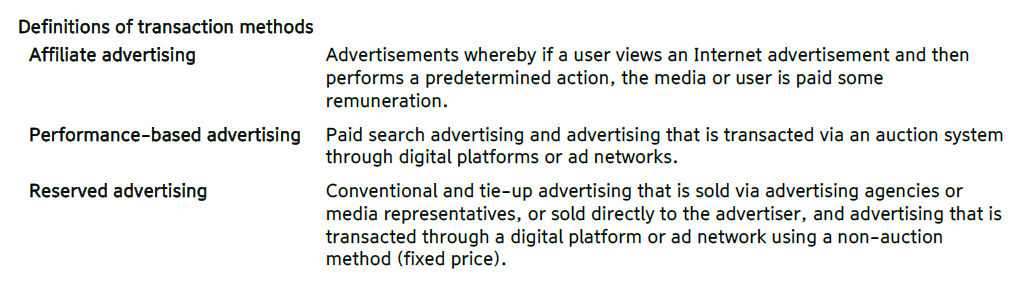

Expenditures on Internet Advertising Media: Breakdown by Transaction Method

--Performance-based advertising amounted to 2,118.9 billion yen, exceeding 2,000 billion yen for the first time since estimates began.--

Analyzed by transaction method used for Internet advertising media expenditures, performance-based advertising grew 15.3% year on year. It reached 2,118.9 billion yen and, for the first time since these estimates have been calculated, the figure was more than 2,000 billion yen and accounted for 85.4% of overall Internet advertising media expenditures. Reserved advertising grew 17.7% and affiliate advertising 2.7%, with both methods achieving year-on-year growth. (Graph 2)

Graph 2. Expenditures on Internet Advertising Media by Transaction Method

Expenditures on Internet Advertising Media: Transaction Method and Advertising Category Cross Tabulation

--In video advertisements, reserved advertising rose 17.4% year and year, and performance-based advertising 15.1% year on year.--

Cross-tabulating transaction method against advertising category, performance-based paid search advertising accounted for 39.4%, making it the largest sub-category. This was followed by performance-based display advertising, accounting for 26.0%, and performance-based video advertising, for 19.9%. In video advertisements, reserved advertising rose 17.4% year and year, and performance-based advertising 15.1% year on year. (Graph 3)

Graph 3. Expenditures on Internet Advertising Media: Transaction Method and Advertising Category Cross Tabulation

Video Advertising Market

--Instream advertising amounted to 345.6 billion yen, accounting for 58.4% of the video advertisement total.--

Within video advertisement expenditures, instream advertising inserted in video content totaled 345.6 billion yen (58.4%), while outstream advertising displayed in online advertising spaces and article content reached 246.3 billion yen (41.6%). (Chart 1)

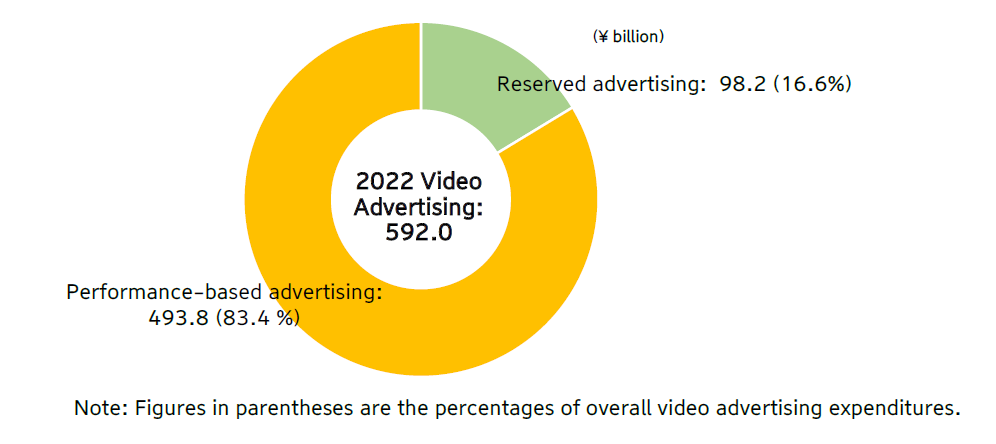

In addition, in terms of transaction method, performance-based advertising accounted for 83.4% of the total. (Chart 2)

Chart 1. Video Advertising Expenditures: Breakdown by Advertising Category

Chart 2. Video Advertising Expenditures: Breakdown by Transaction Method

Social Advertising Market

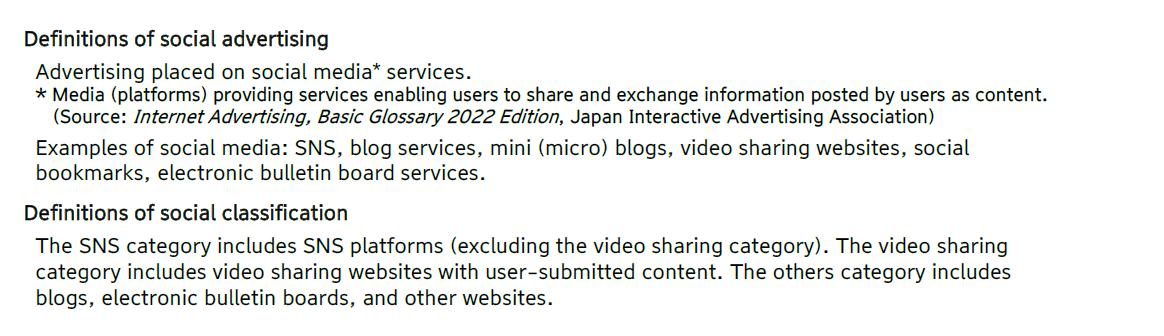

--Social advertising grew 12.5% year on year to 859.5 billion yen, with SNS and video sharing together accounting for 78.3% of the total.--

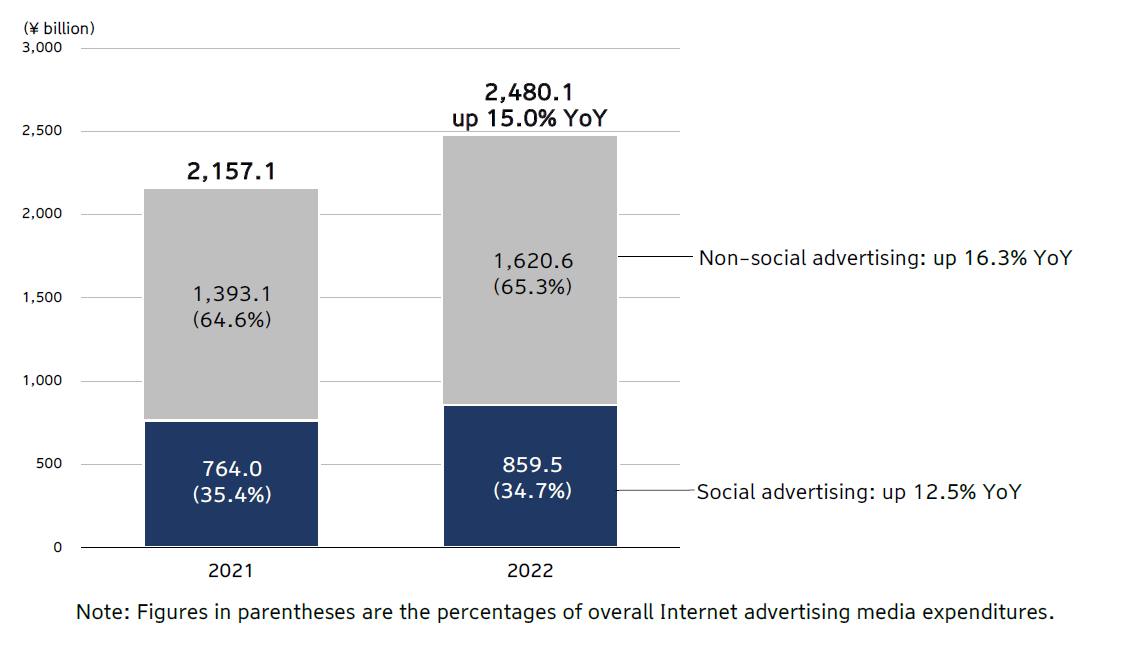

Social advertising in social media services grew 12.5% year on year to 859.5 billion yen, representing 34.7% of overall Internet advertising media expenditures. Non-social advertising increased 16.3% year on year, causing the ratio of social advertising to decrease slightly. (Graph 4)

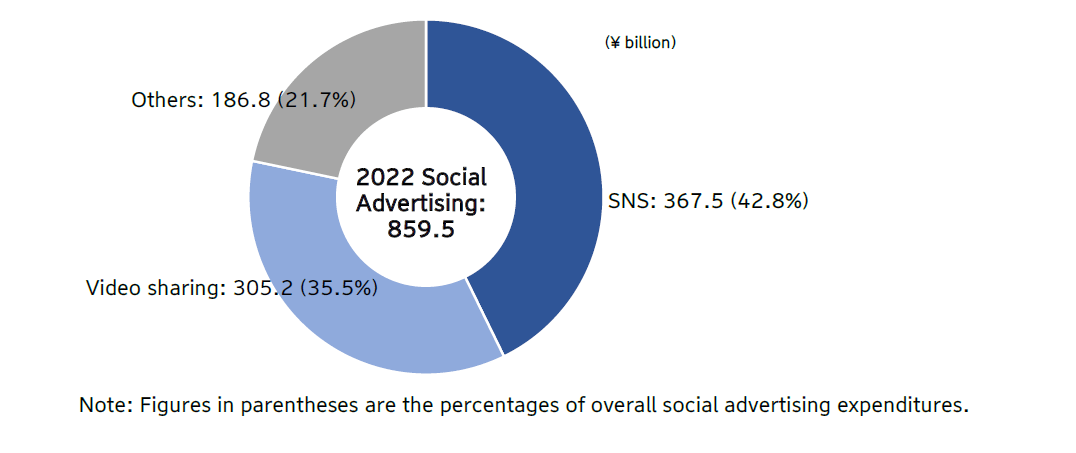

By social media category, SNS amounted to 367.5 billion yen (42.8%) and video sharing to 305.2 billion yen (35.5%), totaling 78.3% of the social advertising expenditures. (Chart 3)

Graph 4. Social Advertising Expenditures

Chart 3. Social Advertising Expenditures by Ad Category

Total Internet Advertising Media Expenditures (Forecast)

--In 2023, total Internet advertising media expenditures in Japan are forecast to increase to 2,790.8 billion yen.--

Internet advertising media expenditures are expected to remain firm in 2023, increasing 12.5% year on year to 2,790.8 billion yen. (Graph 5)

Graph 5. Total Internet Advertising Media Expenditures (Forecast)

Video Advertising Market (Forecast)

--Video advertisements in 2023 are forecast to grow to 685.2 billion yen.--

In 2023, video advertisements are expected to maintain a high growth rate of 15.7% year on year, to reach 685.2 billion yen. Within video advertising, instream advertisements are expected to grow 19.5% year on year. (Graph 6)

Graph 6. Video Advertising Market (Forecast)

#####

Contact

Media-related inquiries:

Corporate Communications Office, Dentsu Corporate One Inc.

Email: global.communications@dentsu.co.jp