Detailed analysis of spending in 2024 and the forecast for 2025, jointly carried out by CCI, Dentsu, Dentsu Digital, and Septeni

CARTA COMMUNICATIONS Inc. (CCI), Dentsu Inc. (Dentsu), Dentsu Digital Inc. (Dentsu Digital), and SEPTENI CO.,LTD. (Septeni), have released a survey titled "2024 Advertising Expenditures in Japan: Detailed Analysis of Expenditures on Internet Advertising Media."

The survey analyzes the results of "2024 Advertising Expenditures in Japan," published by Dentsu on February 27, 2025*, and further breaks down data on internet advertising media spending. The analysis presents data based on variables such as ad category and transaction method. It also includes forecasts for 2025.

*2024 Advertising Expenditures in Japan: https://www.dentsu.co.jp/en/news/release/2025/0227-010859.html

In 2024, advertising expenditures in Japan totaled 7,673.0 billion yen (up 4.9% year on year), the fourth consecutive year of growth since 2021 and the third to reach a new record high.

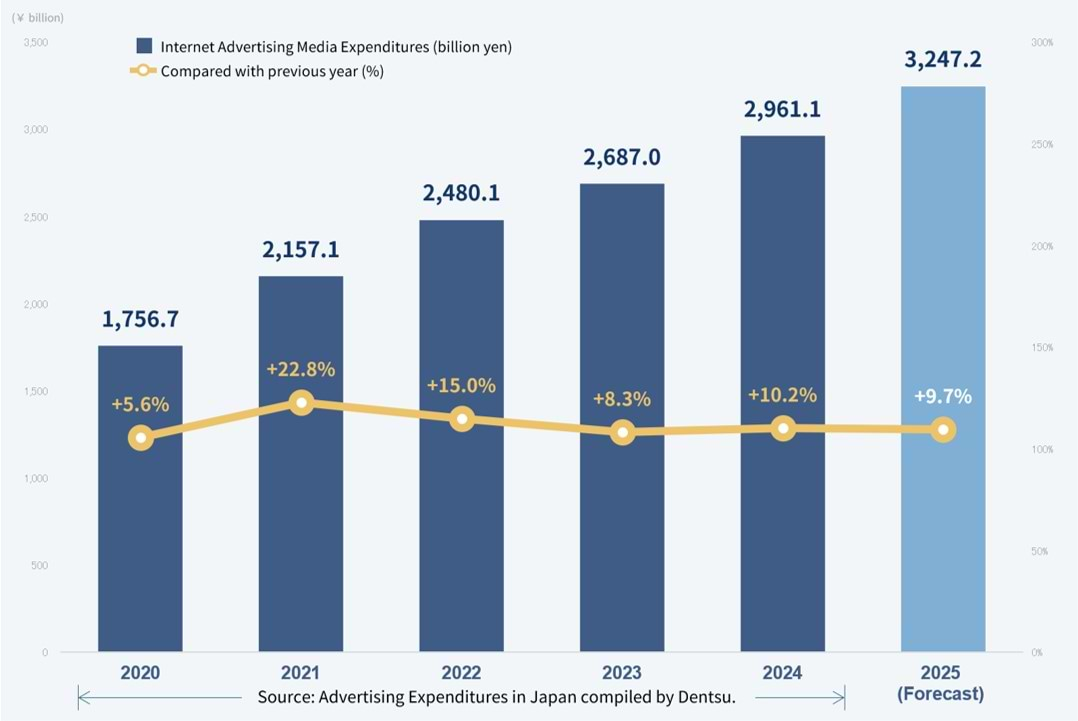

Internet advertising expenditures (estimates began in 1996) grew steadily amid the ongoing digitization of society, increasing by 318.7 billion yen to reach a record-high of 3,651.7 billion yen (up 9.6% year on year), accounting for 47.6% of total advertising expenditures in Japan. Furthermore, excluding internet advertising production costs and advertising expenditures for Merchandise-related EC Platforms, internet advertising media expenditures amounted to 2,961.1 billion yen (up 10.2% year on year) due to growth in video advertising, including strong growth in SNS-based vertical video ads.

The following are the key points of the survey, "2024 Advertising Expenditures in Japan: Detailed Analysis of Expenditures on Internet Advertising Media."

1.Video advertisements posted the highest growth rate, up 23% year on year to 843.9 billion yen.

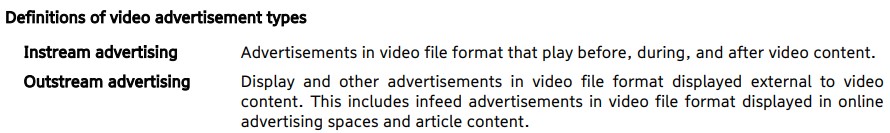

Video advertisements grew 23.0% year on year to 843.9 billion yen, the highest growth rate among all ad categories. Instream advertising amounted to 426.0 billion yen (50.5% of the total), almost the same as outstream advertising, at 417.8 billion yen (49.5% of the total).

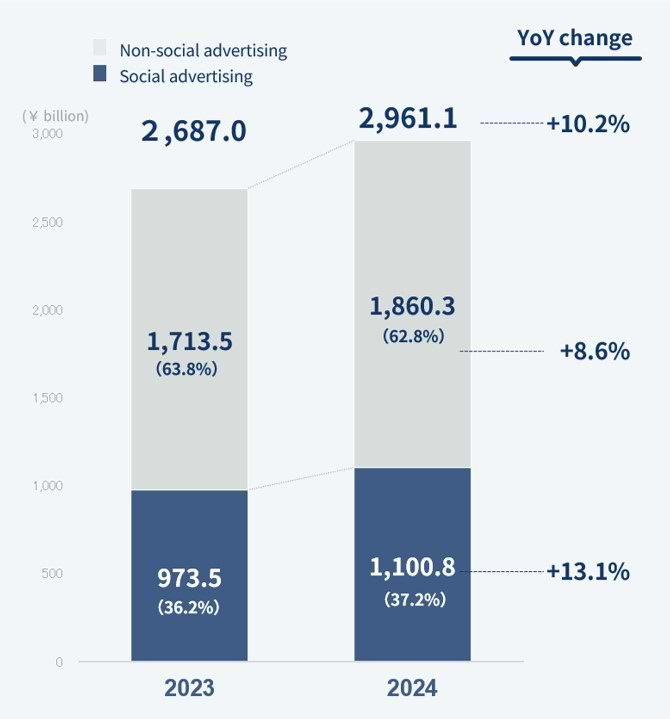

2.Social advertising exceeded the 1,000 billion yen level for the first time since estimates began, reaching 1,100.8 billion yen.

Social advertising in social media services grew 13.1% year on year to 1,100.8 billion yen, marking the first time since estimates began in 1996 for social advertising to exceed 1,000 billion yen. Social advertising accounted for 37.2% of overall internet media expenditures.

3.By ad category, paid search advertising accounts for approximately 40% of all internet advertising media expenditures, the largest single category.

Looking at expenditures on internet advertising media by ad category, paid search advertising accounted for the greatest share of the total at 40.3%, followed by video advertising (28.5%), and display advertising (25.8%). Video advertising expenditures overtook display advertising this year for the first time since estimates began.

4.In 2025, internet advertising media expenditures are forecast to reach 3,247.2 billion yen.

On the back of continued growth in video advertising, social advertising and paid search advertising, internet advertising media expenditures are expected to expand further in 2025, increasing 9.7% year on year to 3,247.2 billion yen. Video advertising is expected to maintain double-digit growth, rising 14.7% year on year to 967.7 billion yen.

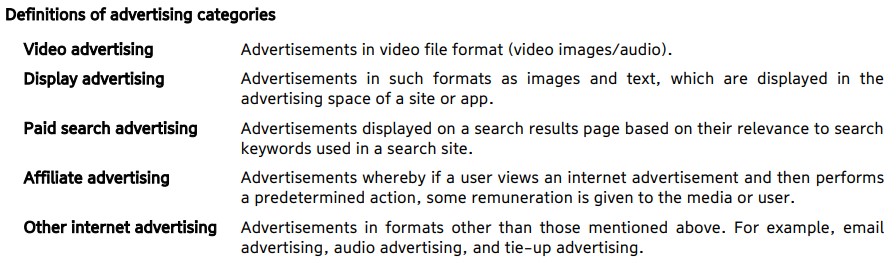

Expenditures on Internet Advertising Media: Breakdown by Advertising Category

―Video advertising grew 23.0% year on year to 843.9 billion yen, the highest growth rate among all advertising categories.―

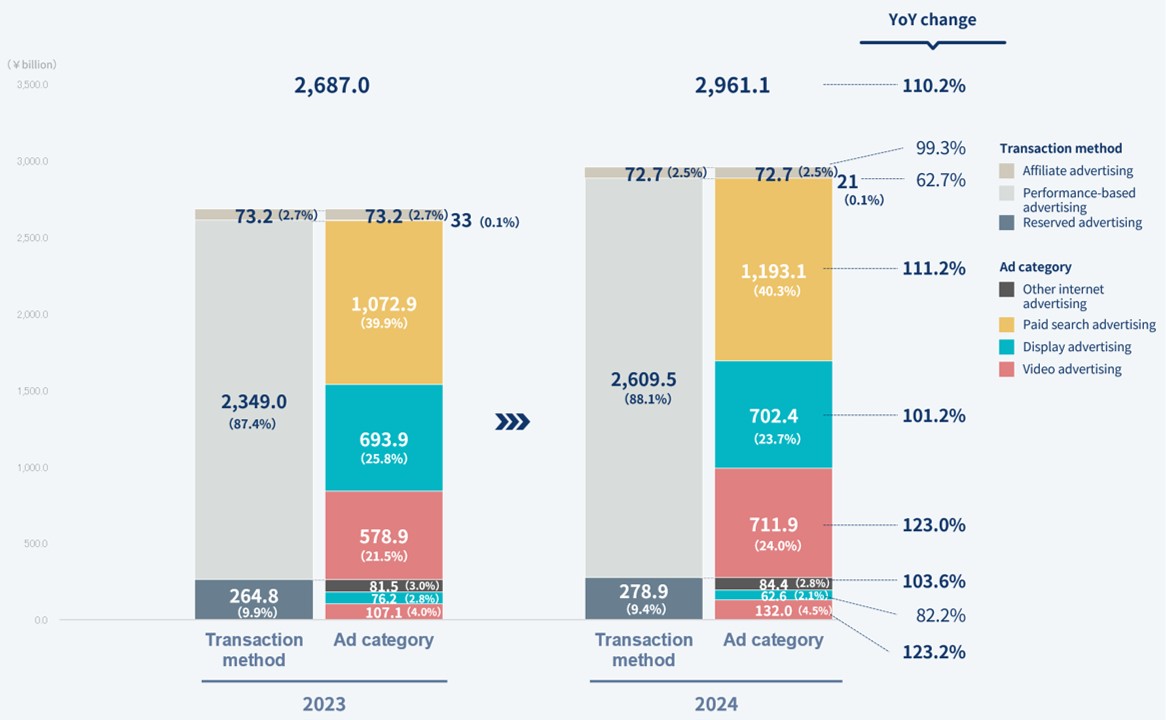

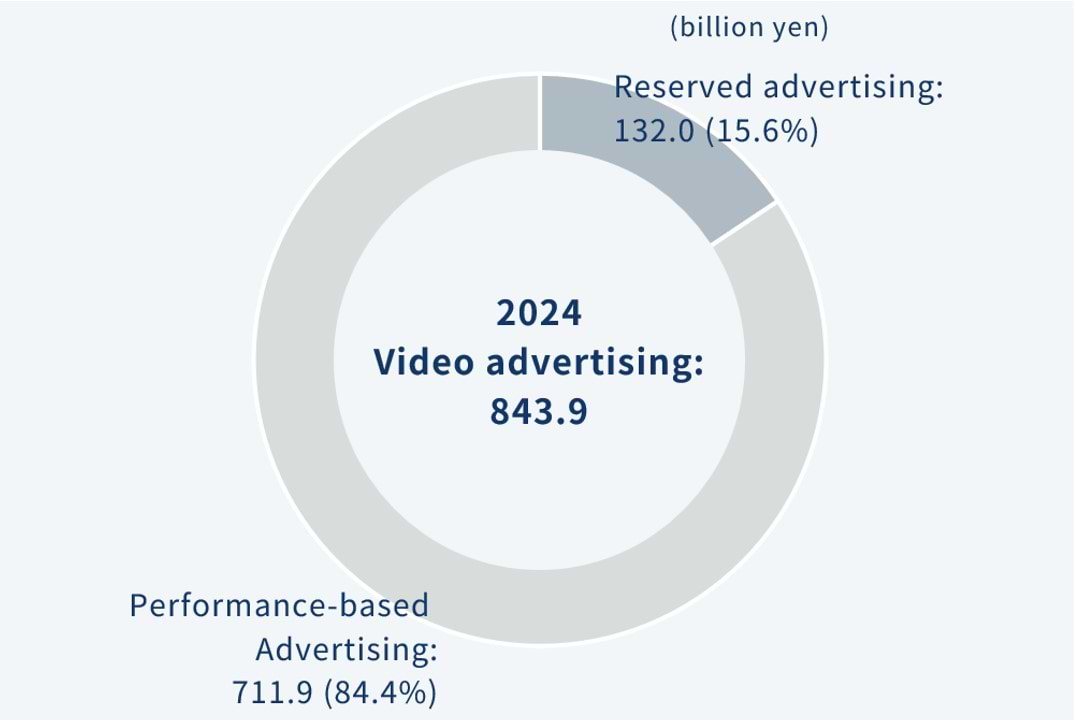

In 2024, internet advertising media expenditures in Japan increased 10.2% year on year to 2,961.1 billion yen (according to "2024 Advertising Expenditures in Japan," published by Dentsu). By ad type, video advertising posted the highest growth rate, increasing 23.0% year on year to 843.9 billion yen, exceeding display advertising for the first time to account for 28.5% of total advertising media expenditures. Paid search advertising, which exceeded 1,000 billion yen in 2023 for the first time since estimates began, continued its robust growth trajectory in 2024, increasing 11.2% year on year to 1,193.1 billion yen. (Graph 1)

Graph 1: Expenditures on Internet Advertising Media: Breakdown by Advertising Category

Note: Figures in parentheses are the percentages of overall internet advertising media expenditures.

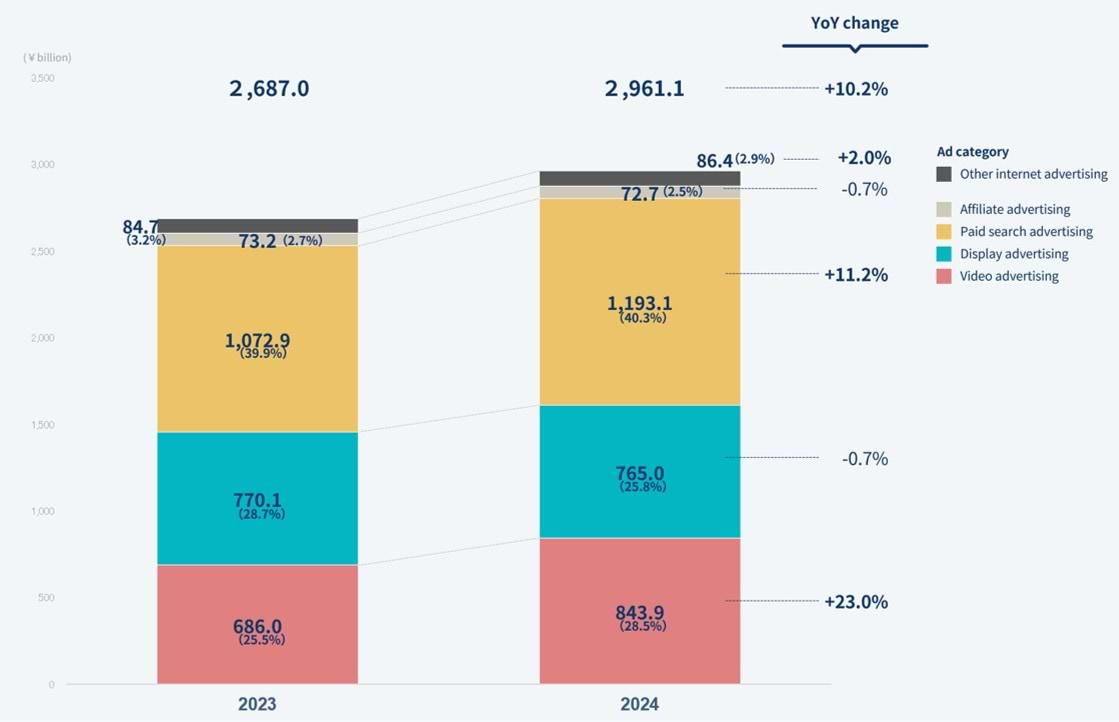

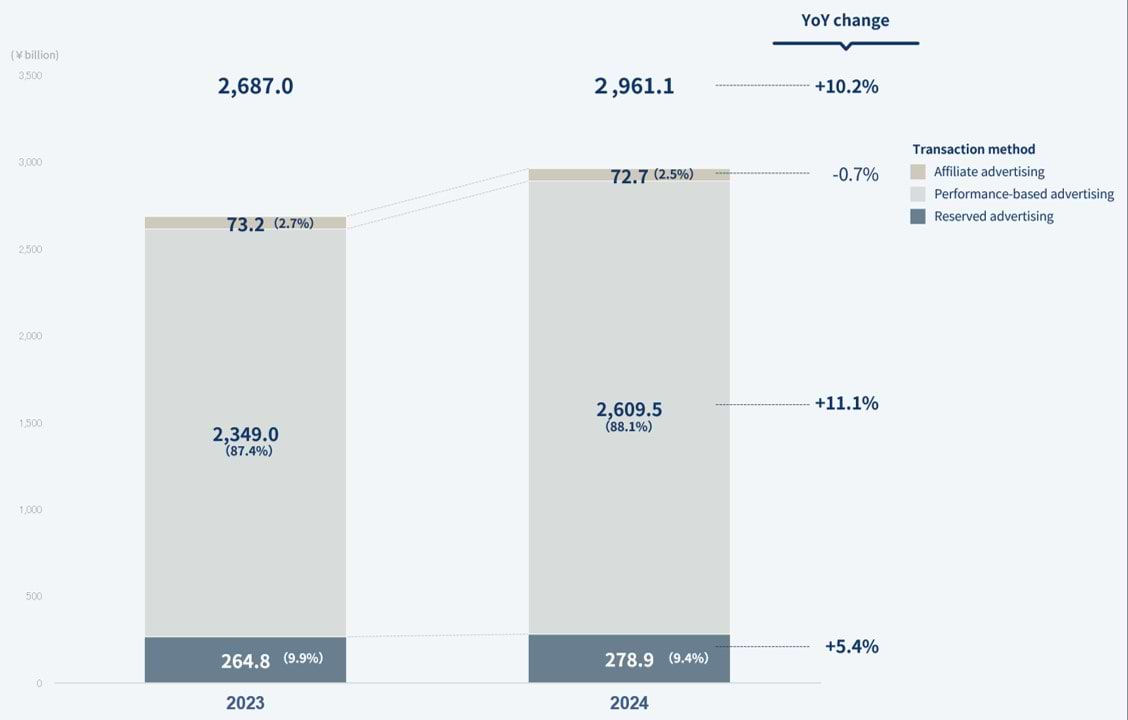

Expenditures on Internet Advertising Media: Breakdown by Transaction Method

―Performance-based advertising reached 2,609.5 billion yen, accounting for nearly 90% of internet advertising media expenditures.―

Looking at internet advertising media expenditures by transaction method, performance-based advertising rose 11.1% year on year to 2,609.5 billion yen, accounting for 88.1% of internet advertising media expenditures. Reserved advertising was up 5.4% year on year to 278.9 billion yen, and affiliate advertising marked a slight decline of 0.7% year on year to reach 72.7 billion yen. (Graph 2)

Graph 2: Expenditures on Internet Advertising Media by Transaction Method

Note: Figures in parentheses are the percentages of overall internet advertising media expenditures.

Expenditure on Internet Advertising Media: Transaction Method and Advertising Category Cross Tabulation

―Within video advertisements growth was significant in both performance-based advertising, which rose 23.0% year on year, and reserved advertising, which was up 23.2% year on year.―

Cross-tabulating transaction method against advertising category, performance-based paid search advertising accounted for 40.3%, the highest among internet advertising media, followed by performance-based video advertising at 24.0%, which exceeded performance-based display advertising (23.7%) for the first time since estimates began. (Graph 3)

Graph 3: Expenditures on Internet Advertising Media: Transaction Method and Advertising Category Cross Tabulation

Note: Figures in parentheses are the percentages of overall internet advertising media expenditures.

Video Advertising Market

―Instream and outstream advertising were almost at the same level.―

Video advertising posted the highest growth rate among all ad categories, increasing 23.0% year on year to 843.9 billion yen. Within video advertising expenditures, instream advertising inserted in video content totaled 426.0 billion yen (50.5%), almost the same level as outstream advertising displayed in online advertising spaces and article content, which reached 417.8 billion yen (49.5%). (Chart 1)

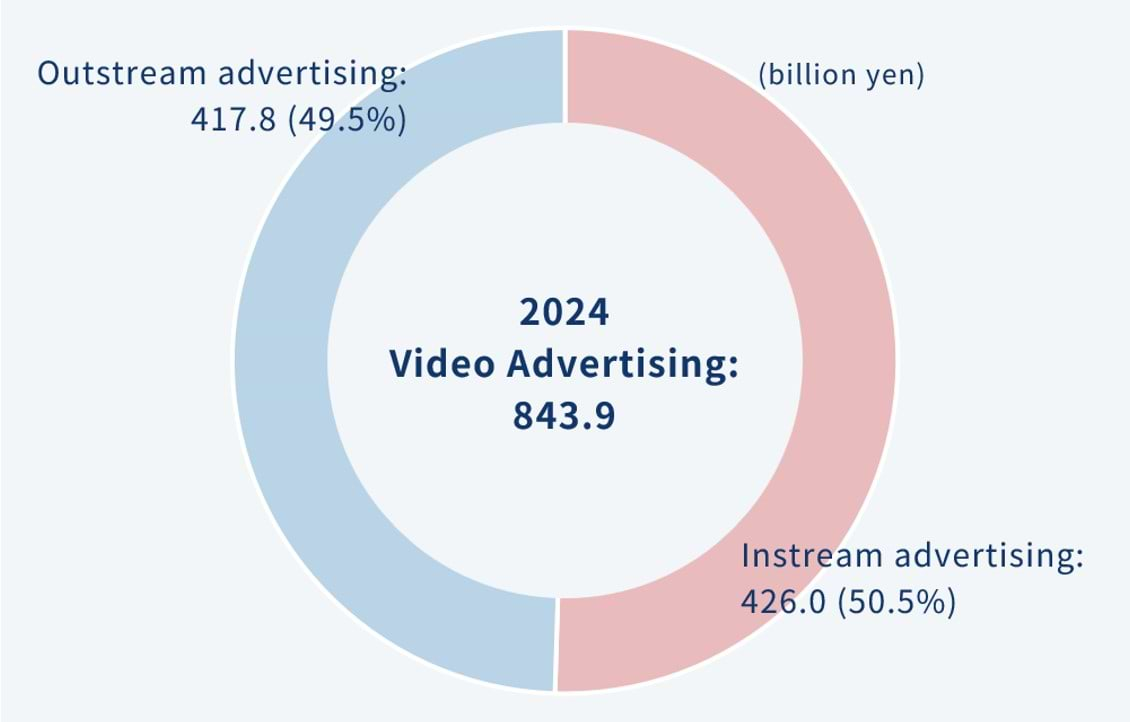

Furthermore, in terms of transaction method, performance-based advertising accounted for 84.4% of the total. (Chart 2)

Chart 1: Video Advertising Expenditures: Breakdown by Advertising Category

Note: Figures in parentheses are the percentages of overall video advertising expenditures.

Chart 2: Video Advertising Expenditures: Breakdown by Transaction Method

Note: Figures in parentheses are the percentages of overall video advertising expenditures.

Social Advertising Market

―Social advertising grew 13.1% year on year to 1,100.8 billion yen.―

Social advertising in social media services grew 13.1% year on year to 1,100.8 billion yen, surpassing the 1,000 billion yen level for the first time since estimates began in 2019, and accounting for 37.2% of internet advertising media expenditures overall. (Graph 4)

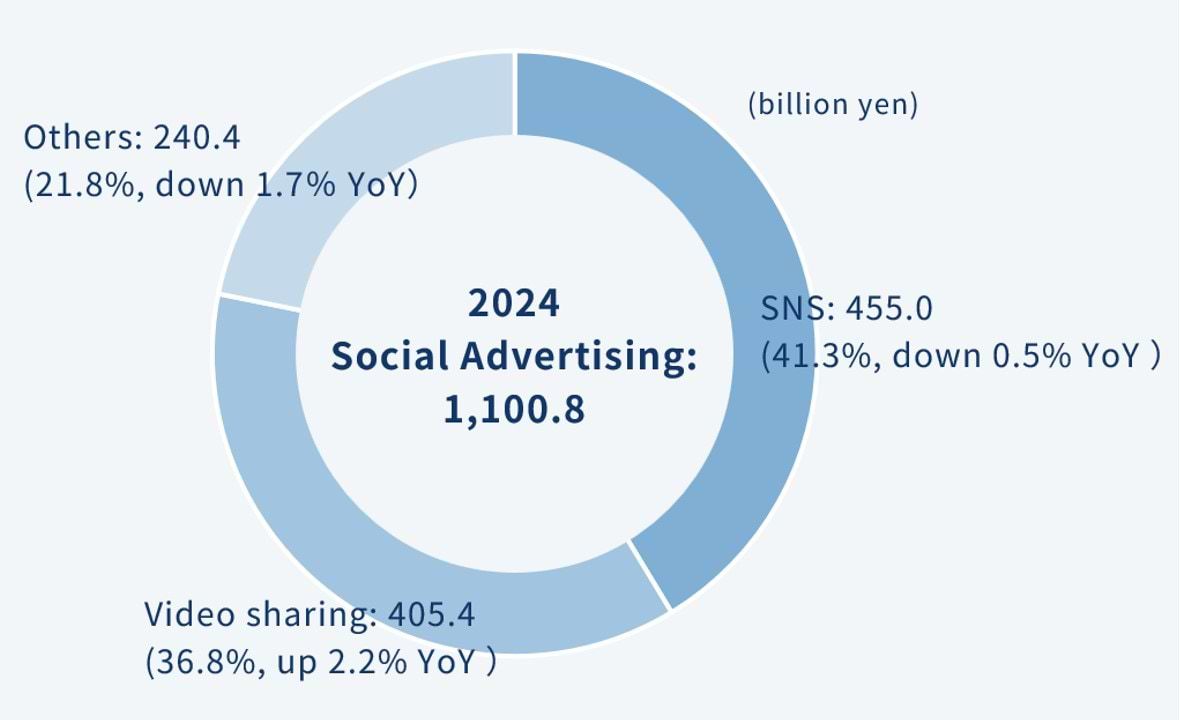

By social media category, SNS (social networking services) amounted to 455.0 billion yen (41.3%) and video sharing saw its share of the total grow year on year to 405.4 billion yen (36.8%), with other categories amounting to 240.4 billion. (Chart 3)

Graph 4: Social Advertising Expenditures

Note: Figures in parentheses are the percentages of overall internet advertising media expenditures.

Chart 3: Social Advertising Expenditures by Ad Category

Note: Figures in parentheses are the percentages of overall internet advertising media expenditures.

Note: Figures in parentheses are the percentages of overall internet advertising media expenditures.

Total Internet Advertising Media Expenditures (Forecast)

―In 2025, total internet advertising media expenditures in Japan are forecast to increase 9.7% year on year to 3,247.2 billion yen.―

Internet advertising media expenditures are expected to maintain steady growth in 2025, increasing 9.7% year on year to 3,247.2 billion yen. (Graph 5)

Graph 5: Total Internet Advertising Media Expenditures (Forecast)

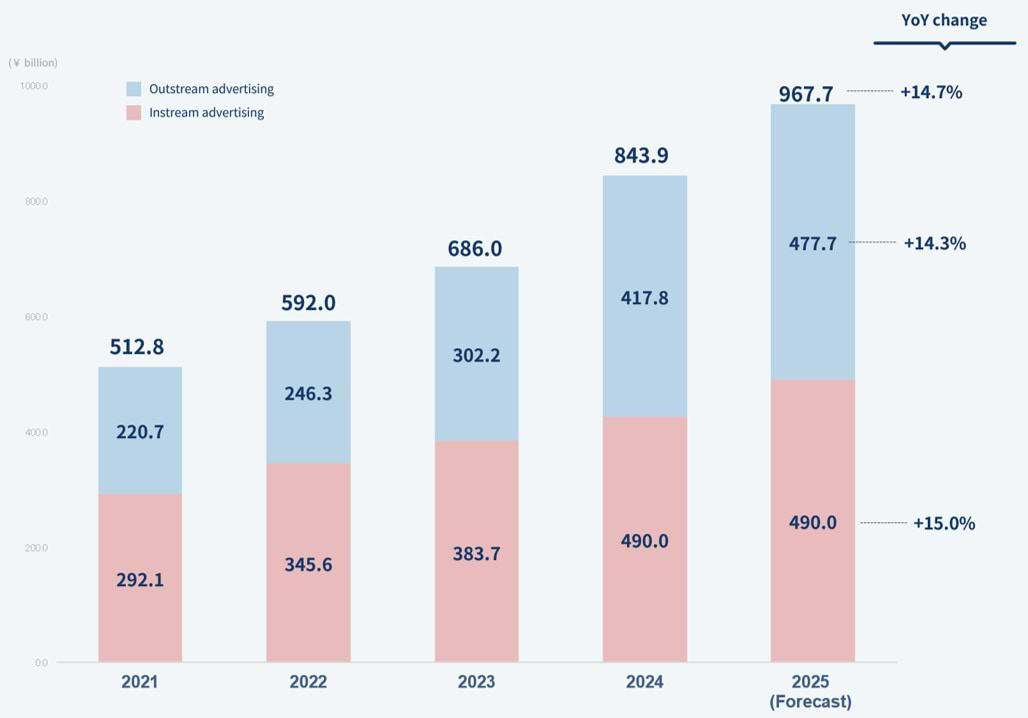

Video Advertising Market (Forecast)

--Video advertisements in 2025 are forecast to grow 14.7% year on year to 967.7 billion yen.--

In 2025, video advertisements are forecast to maintain double-digit growth of 14.7% year on year to reach 967.7 billion yen. Outstream and instream advertisements are expected to grow at about the same rate. (Graph 6)

Graph 6: Video Advertising Market (Forecast)

Note: The figures shown in graphs contained in this release are rounded to the nearest unit. Consequently, some totals differ from the sum of the components shown.

Company profile

CARTA COMMUNICATIONS Inc. (https://www.cci.co.jp/en/)

・Location: Toranomon Hills Station Tower 36F, 2-6-1, Toranomon, Minato-ku, Tokyo,105-5536, Japan

・Representative: Taku Meguro, Representative Director, President

・Business outline:CCI is engaged in comprehensive digital marketing business development. In addition to the sale of advertising space, CCI works with media companies and platformers to develop products, solutions, and services provided to client companies.

Dentsu Inc.(https://www.dentsu.co.jp/en/)

・Location: 1-8-1, Higashi-shimbashi, Minato-ku, Tokyo 105-7001, Japan

・Representative: Takeshi Sano, Representative Director, President and CEO

・Business outline: In addition to providing various solutions for overall client marketing, Dentsu supports the development of efficient advertising in response to changes in the digital age; designs optimal customer experiences; innovates marketing infrastructure; and transforms client business. Dentsu also integrates diverse capabilities that have evolved beyond the marketing domain to provide integrated solutions, which contribute to the sustainable growth of clients and society.

Dentsu Digital Inc.(https://www.dentsudigital.co.jp/en/)

・Location: 1-8-1, Higashi-shimbashi, Minato-Ku, Tokyo, 105-7077, Japan

・Representative: Koh Takimoto, Representative Director, President and CEO

・Business outline: Dentsu Digital is one of the largest integrated digital firms in Japan. With our guiding purpose to: "Inspire people, create new value, and improve how the world works", we are committed to realizing the full potential of new solutions that can emerge from the joining of creativity and technology closer to people's hearts and minds. As a strong partner for our clients' business evolution, our goal is to aim for long-term "transformation and growth" both within the economy and across society through creating new value together.

SEPTENI CO.,LTD.(https://www.septeni.co.jp/en/)

・Location: Sumitomo Shinjuku Grand Tower 28F, 8-17-1 Nishi-Shinjuku, Shinjuku-ku, Tokyo 160-6128

・Representative: Yusuke Shimizu, Representative Director, President

・Business outline: Septeni provides comprehensive support for our client's digital transformation (DX) largely by leveraging our solutions that draw highly from data and AI.

#####

Contact

Media-related inquiries:

Branding Office, Dentsu Corporate One Inc.

Email: global.communications@dentsu.co.jp