--Detailed analysis of spending on Internet advertising media jointly carried out by D2C, CCI, Dentsu, and Dentsu Digital--

D2C Inc. (D2C), Cyber Communications Inc. (CCI), Dentsu Inc. (Dentsu), and Dentsu Digital Inc. (Dentsu Digital) have released a survey titled "2020 Advertising Expenditures in Japan: Detailed Analysis of Expenditures on Internet Advertising Media." This survey analyzes the results of "2020 Advertising Expenditures in Japan" published by Dentsu on February 25, 2021--and further breaks down data on Internet advertising media spending. The analysis presents data according to such variables as ad category and transaction method. It also includes forecasts for 2021.

Due to the impact of the global spread of the novel coronavirus disease (hereinafter referred to as COVID-19) in 2020, advertising expenditures in Japan totaled 6,159.4 billion yen (88.8% of the previous year's figure). Despite signs of recovery after the fall, the result is significantly lower than that of the previous year. Internet advertising expenditures continued to grow, though negatively impacted by COVID-19, becoming a market of 2.2 trillion yen, comparable with four major traditional media advertising expenditure and accounting for 36.2% of total advertising expenditures overall. Furthermore, excluding Internet advertising production costs and advertising expenditures for Merchandise-related EC Platforms, Internet advertising media expenditures amounted to 1,756.7 billion yen (up 5.6% compared with 2019) due to the further expansion of performance-based advertising and increases in social advertising and video advertising, driven by demand resulting from people staying at home.

Key points of the "2020 Advertising Expenditures in Japan: Detailed Analysis of Expenditures on Internet Advertising Media" follow.

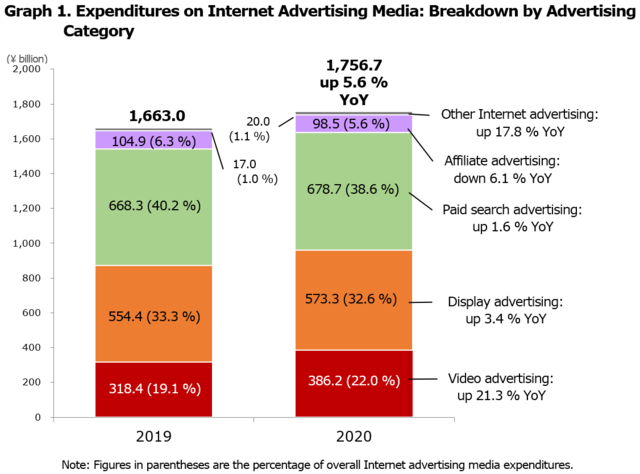

1. Video advertisements amounted to 386.2 billion yen, more than 20% of total Internet advertising media expenditures.

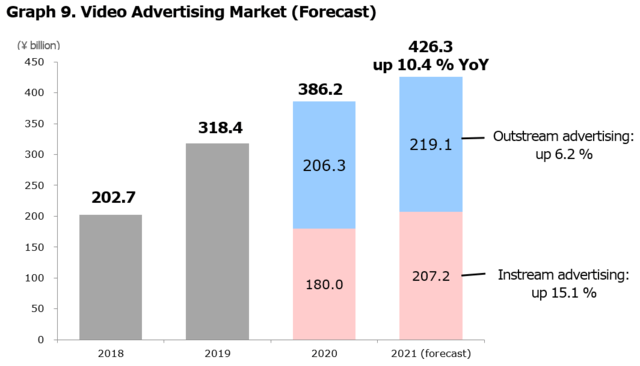

Video advertisements amounted to 386.2 billion yen, up 21.3% compared with the previous year, accounting for 22.0% of total Internet advertising media expenditures. Video advertisements break down to 46.6% for instream advertising and 53.4% for outstream advertising (first-time estimate). In 2021, video advertising is forecast to grow 10.4% year on year to 426.3 billion yen.

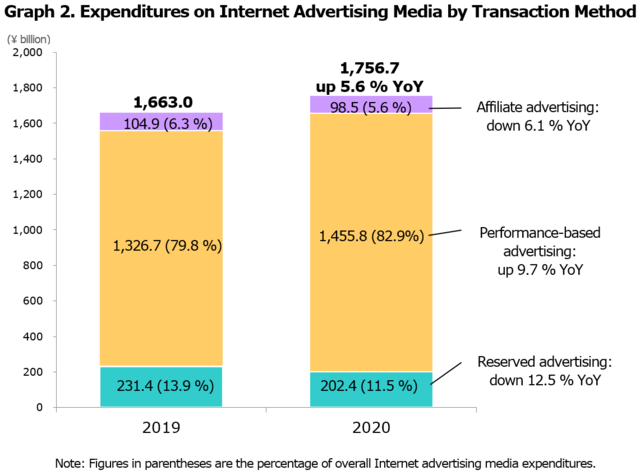

2. Performance-based advertising grew 9.7% compared with the previous year, while reserved advertising and affiliate advertising declined.

Performance-based advertising, which is the main transaction method, grew 9.7% year on year to 82.9% of total Internet advertising media expenditures. Reserved advertising and affiliate advertising declined from the previous year.

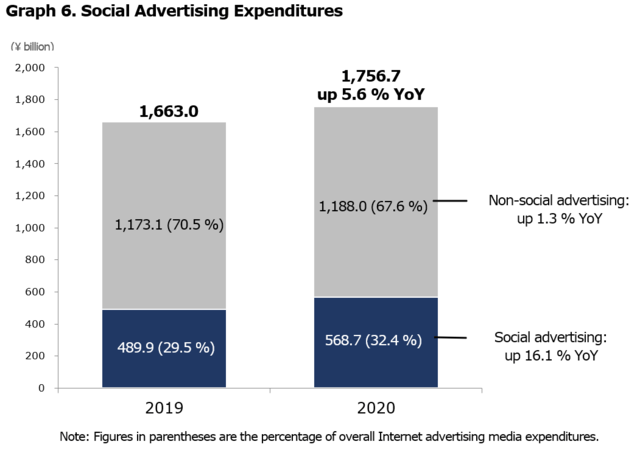

3. Social advertising amounted to 568.7 billion yen, accounting for over 30% of overall expenditures on Internet advertising media.

Social advertising placed on social media, video-sharing, and other platforms grew 16.1% compared with the previous year, amounting to 568.7 billion yen and accounting for 32.4% of overall expenditures on Internet advertising media.

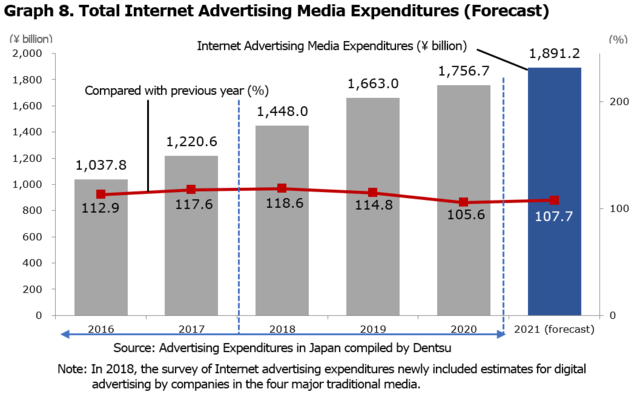

4. In 2021, Internet advertising media expenditures overall are forecast to grow 7.7%, to 1,891.2 billion yen.

In 2021, despite the ongoing impact of COVID-19, Internet advertising media expenditures overall are forecast to grow 7.7% to 1,891.2 billion yen.

Expenditures on Internet Advertising Media: Breakdown by Advertising Category

--Video advertisements grew significantly to 386.2 billion yen, up 21.3% from the previous year, exceeding 20% of total Internet advertising media expenditures.--

In 2020, Internet advertising media expenditures in Japan amounted to 1,756.7 billion yen (according to "2020 Advertising Expenditures in Japan," published by Dentsu). Of the total, the two largest ad categories were paid search advertising (38.6%) and display advertising (32.6%), giving the two categories a combined share amounting to 70%. Video advertisements grew 21.3% compared with the previous year, amounting to 386.2 billion yen, accounting for more than 20% of the total. This was followed by affiliate advertising, with 5.6%, while other Internet advertising accounted for 1.1%. (Graph 1)

Expenditures on Internet Advertising Media: Breakdown by Transaction Method

--Performance-based advertising grew 9.7%, reserved advertising and affiliate advertising declined.--

Analyzed by transaction method used for Internet advertising media expenditures, performance-based advertising--the principal transaction method--amounted to 1,455.8 billion yen (over 80% of total Internet advertising media expenditures). At the same time, despite signs starting in the fall of a recovery in reserved advertising and affiliate advertising, the spread of COVID-19 caused a decline in both reserved advertising (down 12.5%) and affiliate advertising (down 6.1%). (Graph 2)

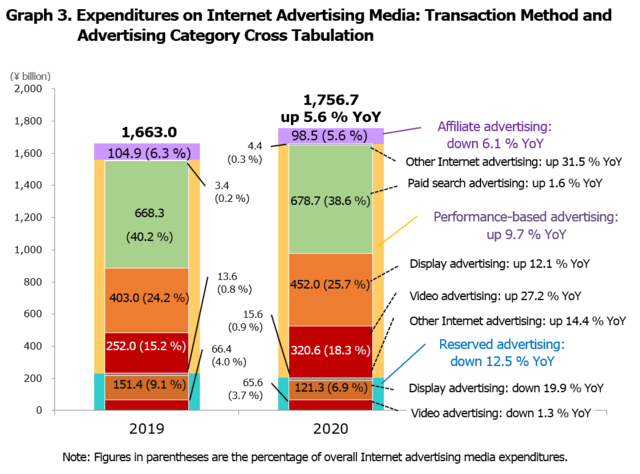

Expenditures on Internet Advertising Media: Transaction Method and Advertising Category Cross Tabulation

--Substantial growth in performance-based video advertising (up 27.2%) accounting for 18.3% of Internet advertising media expenditures.--

Cross-tabulating transaction method against advertising category, performance-based paid search advertising accounted for 38.6%, making it the largest sub-category, followed by performance-based display advertising, which accounted for 25.7%. Additionally, substantial growth in performance-based video advertising (up 27.2%) accounted for 18.3% of Internet advertising media expenditures. Reserved display advertising declined 19.9% compared with the previous year, while performance-based display advertising grew 12.1%. (Graph 3)

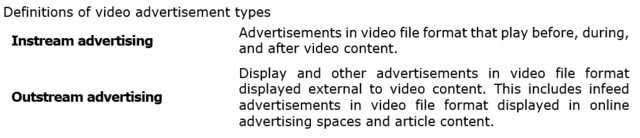

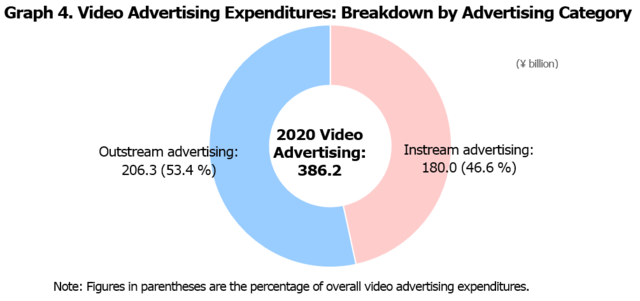

Video Advertising Market

--Within video advertisement expenditures amounting to 386.2 billion yen, instream advertising expenditures accounted for 46.6% and outstream advertising expenditures for 53.4% of the total. Performance-based advertising accounted for over 80% of transaction methods.--

Within video advertisement expenditures amounting to 386.2 billion yen, instream advertising inserted among video content amounted to 180.0 billion yen (46.6%) and outstream advertising displayed in online advertising spaces and article content amounted to 206.3 billion yen (53.4%). (Graph 4)

Additionally, in terms of transaction methods, performance-based advertising amounted to 320.6 billion yen, or over 80% of the total. (Graph 5)

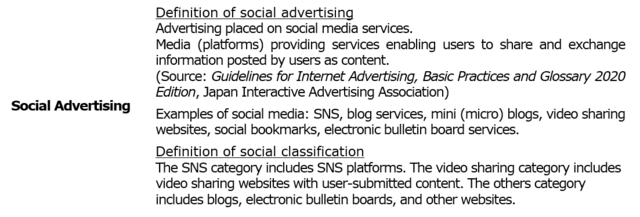

Social Advertising Market

--Social advertising expenditures grew substantially (up 16.1%), accounting for over 30% of overall Internet advertising media expenditures.--

Social advertising placed on social media services grew at a high rate of 16.1% compared with the previous year, amounting to 568.7 billion yen and accounting for over 30% of overall Internet advertising media expenditures. (Graph 6)

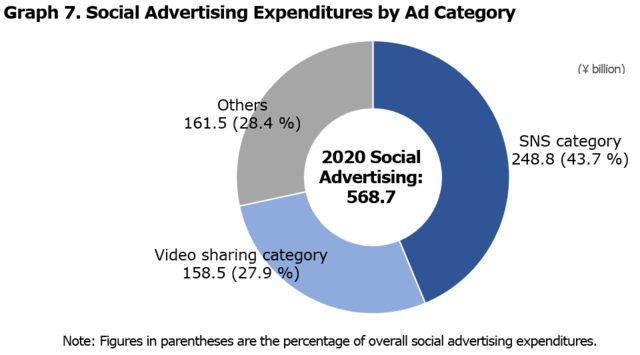

Furthermore, when social media are placed in "SNS," "video sharing," and "others" categories, the SNS category has the largest scale at 248.8 billion yen. The video sharing category grew substantially compared with the previous year. (Graph 7)

Total Internet Advertising Media Expenditures (Forecast)

--In 2021, total Internet advertising media expenditures in Japan are forecast to increase 7.7% compared with 2020, to 1,891.2 billion yen.--

Despite the ongoing impact of COVID-19, total Internet advertising media growth is expected to continue in 2021, to reach 1,891.2 billion yen. (Graph 8)

Video Advertising Market (Forecast)

--Video advertisements in 2021 are forecast to grow to approximately 426.3 billion yen.--

In 2021, video advertisements are expected to grow 10.4% compared with the previous year, expanding to 426.3 billion yen.

Research Overview

Research organizations D2C Inc., Cyber Communications Inc., Dentsu Inc., Dentsu Digital Inc.

Research period December 2020-February 2021

Research methodology Carried out estimates based on the following research

1. Research based on questionnaire surveys covering Internet advertising media companies, etc. (postal research/web research)

The research was conducted by explaining to respondents that the survey would be asking about "2020 Advertising Expenditures in Japan" Internet media expenditures

2. Same as above, but with additional interview research

3. Various types of data collection and analysis

Note: The figures shown in graphs contained in this release are rounded to the nearest unit. Consequently, some totals differ from the sum of the components shown.

#####

Contact

Media-related inquiries: Corporate Communications Division