Corporate DX (digital transformation) is becoming increasingly important, not just in Japan but also in China. This is why Japanese businesses in the Chinese market must be prepared to adapt to the “China DX.”

Dentsu Group has been offering “DX Diagnostics China” which was adapted from the original version developed for Japan to Japanese companies in China.

Click here for DX Diagnostics articles (Japanese only).

Hajime Yamamoto from Global Business Center, Dentsu Inc. asked Hirotoshi Tanaka from the Shanghai office of dentsuMB China who supports Japanese businesses about the purpose of DX Diagnostics China and the latest from the local market.

HAJIME YAMAMOTO

General Manager,

Network Business Div.1, GBC,

Dentsu Inc.

HIROTOSHI TANAKA

Dupty General Manager / Chief Digital Officer,

dentsuMB China Shanghai Office

Challenges Japanese businesses face in China, the leading nation in DX

Yamamoto: What services does Shanghai Dentsu offer to your clients?

Tanaka: We provide solutions against the various marketing challenges mainly for Japanese businesses with a base in Shanghai, around advertising and sales promotion campaigns. As you know, it’s been amazing to see the speed at which China has adopted their unique digital ecosystem along with the incredible progress in their marketing methodology. In such a market, we have numerous clients who are looking for DX solutions given how we are still dealing with the impact of COVID on the society.

Yamamoto: Can you tell us how you have begun to develop “DX Diagnostics China?”

What is DX Diagnostics?

What is DX Diagnostics?"Marketing DX" is an area related to customer contact point and DX Diagnostics is a solution that measures the progress of DX using deviation score based on an original research Dentsu has carried out (click here for a press release: Japanese only).

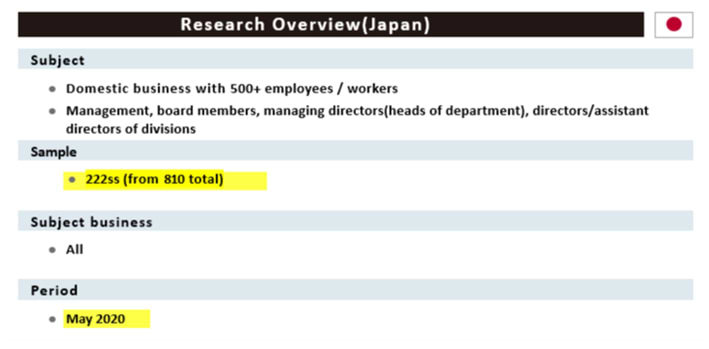

Research conditions for both Japan and China at the end of article.

What is DX Diagnostics?

What is DX Diagnostics?"Marketing DX" is an area related to customer contact point and DX Diagnostics is a solution that measures the progress of DX using deviation score based on an original research Dentsu has carried out (click here for a press release: Japanese only).

Research conditions for both Japan and China at the end of article.

Tanaka: In China, a market that is advanced in DX, we are getting many requests from the management of the Chinese operation within Japanese companies who are looking to “drive DX for survival” or “innovate their business model by leveraging the leading DX examples in the Chinese market.” What lies behind this is the fast-paced digital transformation we saw due to COVID and the increasing importance of the Chinese market in their sales share.

Traditionally, Japanese management operating in China tended to place importance on “supply chain management” and “localizing the Japanese HQ model.” However, in the last few years, “creating a business model with the perspective of the local clients” and “driving DX” have become increasingly important.

As Dentsu Group, we are painfully aware of the importance for Japanese companies to have a clear direction by fully embracing the issues as they drive business transformation and DX. This is why we believe that DX Diagnostics will be effective as it had already generated results in Japan. However, the digital environment is starkly different between the two countries that the teams in Tokyo and China worked tirelessly to address these differences to tailor DX Diagnostics for the Chinese market.

“DX Diagnostics China” that captures the “4 characteristics” of the Chinese market

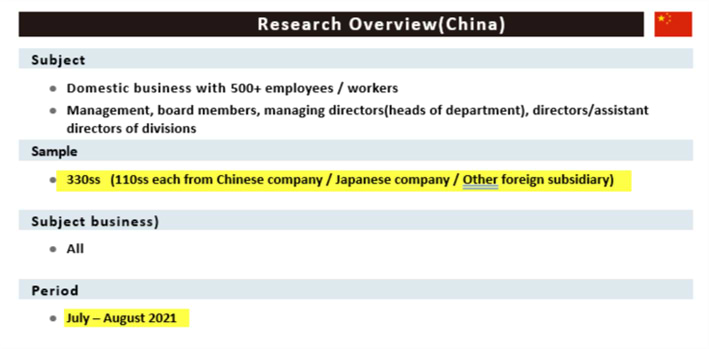

Yamamoto: With DX Diagnostics, normally, we quantify the deviation to identify the level of DX engagement from the 3 strategic perspectives:

✔ Vision

✔ Customer-first

✔ Progress of DX

based on interviewing four areas of the business:

- Customer Experience

- System

- Data / Human Resource

- Organization / Tasks

From there, we identify the issues and incorporate people’s insight to propose solution for marketing DX. What are the characteristics of DX Diagnostics China?

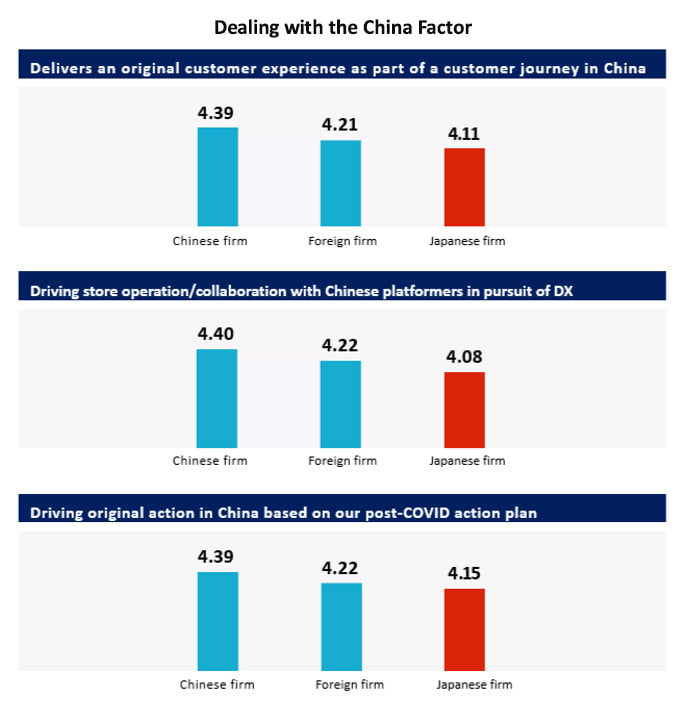

Tanaka: We’ve identified various differences between the two markets out of which we focus on the following four areas which was summarized as the 5th area of diagnostics which we named, the “China Factor.”

- CX (customer experience) tailored to the Chinese market

- CX innovation that can adapt to the fast-paced change in the market

- Relation with the China-based platformers

- Own post-COVID action

Yamamoto: What strengths of Japanese businesses have you uncovered through the research?

Tanaka: The fact that the “customer-first thinking” is pervasive across the business. Japanese companies are good at actively attempting new approaches to drive this customer-first mindset by gathering data from various contact points, incorporating the results of the customer satisfaction survey to truly personalize CX for each individual customer.

Despite such effort, due to the rigid organization structure and the lack of a clear vision for the company, they are not able to fully translate their endeavors into results.

However, I don’t believe this failure to fully optimize their efforts is something to be pessimistic about. I know that we can find the solution by understanding the ‘strength’ and the ‘challenges.’

Yamamoto: Can you tell us a little more about what the Japanese businesses lack?

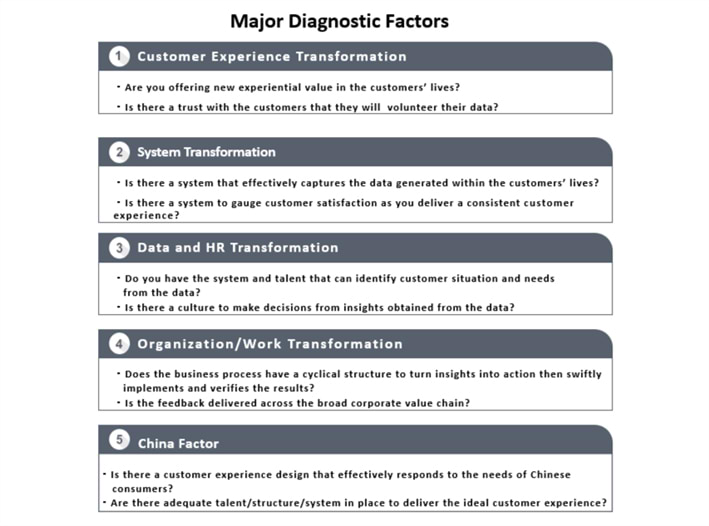

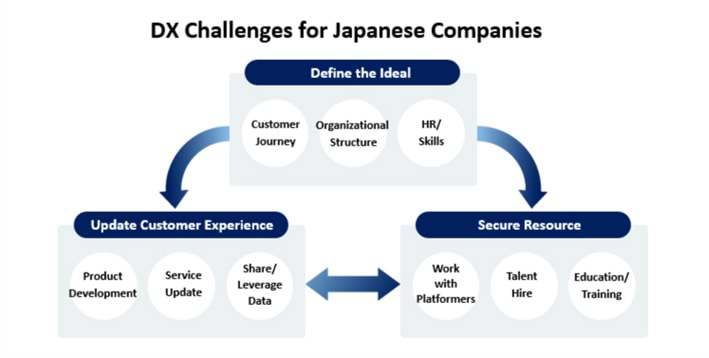

Tanaka: As I said earlier, it’s the vision for the future and the definition of the customer journey. Because the “organizational structure and the work process essential for driving the optimum CX,” in other words, the goal, is unclear, we are now beginning to see the reality where the entire organization struggles to embrace DX.

Leading Chinese and global firms are quick to adopt the new CX design based on the latest technology and through trial and error, can swiftly update their customer experience.

Yamamoto: How are Japanese businesses dealing with the “China Factor” you mentioned earlier?

Tanaka: Unfortunately, not all that well. The fact that they aren’t able to fully “coordinate with the platformer,” which is critical to designing a customer journey in China, is holding them back from driving user action or value which is inherently based on the very journey.

Yamamoto: It sounds like there are mounting issues.

Tanaka: Yes, it’s true that there are numerous challenges that Japanese businesses must overcome. But looking at the potential of the Chinese market, it is a challenge worth taking on given the possibility to reap great benefits.

Also, the strength and challenges of Japanese businesses which we touched on do not only apply to China. I find that while there are differences in in the platformer environment and the speed of digitalization, it is a common challenge that exists in any market you do business in across the world. In that sense, I think it’s fair to say that deciphering the way through the leading DX nation, China, is the way to making it in the global market.

Yamamoto: I understand you have already begun offering DX Diagnostics China to some Japanese firms. What are the responses so far?

Tanaka: Some of the responses we received so far are “We were able to identify our market position by benchmarking again industry competitors and Chinese companies,” “It gave us an opportunity to not just focus on the ongoing ERP (Enterprise Resource Planning) adoption but also new CX as well as rethink about our CRM (Customer Relationship Management) efforts.” We feel that DX Diagnostics China is a great support tool to bring value for any business as it provides a relative and objective understanding of the importance of DX from a customer/marketing perspective.

China is a great place to try out BX and DX

Yamamoto: Finally, what is your take on the significance of Japanese businesses engaging in DX in China?

Tanaka: Digital infrastructure is better established in China than in Japan which can serve as a place to “test out DX.” I am confident that taking on the DX challenge by recognizing the strength and issues of Japanese businesses which came to light through DX Diagnostics is the key for Japanese companies to transform their businesses.

The speed of change in the Chinese market is staggering. For example, the norm within the Chinese e-commerce practice until recent was to open a retail outlet on platforms such as Alibaba and JD.com. But this is already evolving and one factor is D2C. The recent change in the online media/content, the growing cost-conscious mindset, and the progress in data technology is shifting focus away from business models that are reliant on platform-based e-commerce. Another factor is the ‘private traffic.’ This is an extremely popular model in China where a company will collect their own customer data, develop a community, and drive conversion for their business.

Being a place to try out new marketing methods such as D2C and private traffic is another reason that makes China an attractive market to operate in. At Dentsu, we hope to support such Japanese companies to accompany them on their journey to create successful cases.

Yamamoto: Thank you.

For any enquiries about the result of the DX Diagnostics China as well as any DX-related consultation, please feel free to contact Global Business Center, Dentsu Inc.