◆ What is the mass affluent segment?

What image comes to mind when you think of the affluent? Perhaps you picture a celebrity, living in Roppongi, driving a Ferrari, drinking wine in a fancy restaurant every evening.

Of course, the first thing that people typically imagine is the super wealthy, with assets and incomes in the multi-millions of yen. But people in this class are just a tiny proportion of the total.

The consumer market surveyed in this report differs little from this image of the super wealthy, the people that we refer to as the mass affluent segment. Adding the prefix "mass" may seem a little strange. However, the growth rate for the affluent segment in Japan is the highest in the world. Coupled with the effects of Abenomics, the number of wealthy have increased to become a "mass segment."

Who make up the mass affluent segment, how do they think, and what sort of lives do they live?

Dentsu, together with Hearst Fujingaho, publisher of fashion magazines such as 25ans, Richesse and Fujingaho, conducted a survey1 to determine the attitudes and consumption behavior of affluent women in Japan.

The definition of "affluent" as used for this survey is "people with household net assets, excluding mortgages and other debt, of ¥100 million (approx. US$880,000) or more." This represents 6% of all households in Japan, or 3.36 million households. We also considered as wealthy those "people with household income of ¥20 million (approx. US$176,000) or more." Such people represent 1% of all households in Japan, or 560,000 households.

Members of this mass affluent segment use money when they consume, and have a considerable impact in the real consumer market.

The characteristics of wealthy women were revealed in the survey. Let's take a peek into their world.

◆ Affluent women live well and elegantly

Let's begin with a look at the characteristics of wealthy women in general. The figures in parentheses below are the average scores for ordinary women, derived from Dentsu's "d-camp X" survey.2

Monthly discretionary budget of ¥200,000 (approx. US$1,760)

A total of 27.5% of wealthy women polled responded that they have at least ¥200,000 (approx. US$1,760) to spend as they like each month. More than half of these women, a full 16.8%, said they had no upper limit for spending. Among ordinary women, just 0.3% have a discretionary budget of ¥200,000 or more, with 93.3% reporting that they have less than ¥50,000 (approx. US$440). These figures reveal the robust spending power of the mass affluent.

Active investors

A total 61.5% of wealthy women (25.5% of ordinary women) have an interest in investing. Many are actually investing in some form, with the greatest proportion in domestic stocks at 65.4% (6.3%).

During follow-up interviews, many respondents asserted that they "weren't investing all that much," but had stock portfolios worth ¥10 million (approx.US$88,000) or more. Along with stocks, these women also invest in finance and real estate.

Willing to spend on education

A full 74.8% of wealthy women (45.0% of ordinary women) said that they don't curtail their spending on education. Recently, many services, targeting the mass affluent segment, have been developed that cater to parents keen on education.

Other mothers are generally among these women's acquaintances. Being passionate about education, many send their children to private schools, and form connections with other mothers who share similar values and economic status. These relationships continue long after the children have graduated.

Actively spend on health

A total 45.0% of wealthy women (21.3% of ordinary women) said that they have healthy eating habits, and use various means to maintain their health. They also don't mind spending money on, or making an effort for their health, with 41.7% (14.6%) stating that "spending money in the interests of my health doesn't bother me." Interviews revealed a tendency to purchase supplements and health foods, and to use services such as sports clubs and beauty salons.

Fond of luxury items

Affluent women want to be perceived as refined. A total 32.0% of wealthy women (11.3% of ordinary women) stated that their ideal personal image is "refined." Their concept of refined tends toward "internal beauty," such as an accomplished demeanor, a way of thinking, etiquette and manners, as well as composure and language.

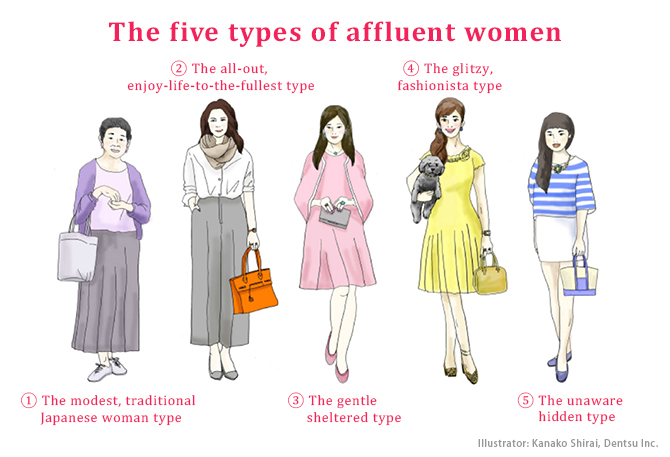

◆ The five types of affluent women

The affluent do not all share the same values. They have a variety of priorities and values regarding spending, and unless companies are able to adapt to these attributes, they won't be able to fully connect with affluent consumers. This survey groups the affluent segment into five types, based on their values and consumer mindset.

Affluent Women: the Five Types

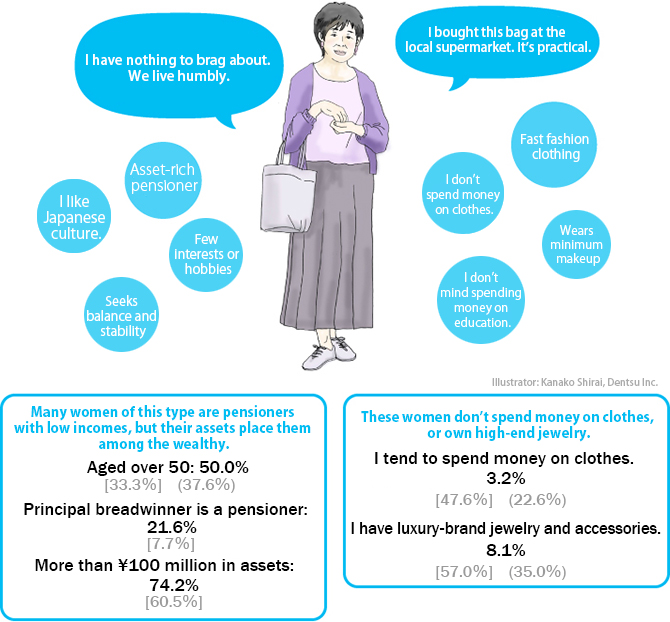

1. The modest, traditional Japanese woman type

The assets she has inherited are to be protected rather than used.

This woman is staunchly conservative, protecting the home and assets inherited from her forebears. This type has the greatest proportion of women over 50, mainly asset-rich pensioners.

Compared with the other types, she has low motivation to spend and doesn't own luxury-brand items.

She likes Japan and Japanese culture. She rarely spends money on such things as beauty services, fashion, or brand-name goods. Her everyday outfits are fast fashion or supermarket clothes, and her cosmetics are from the drugstore. She does not make impulse purchases. However, she does tend to spend money on her family, for example on education.

Characteristics of the modest, traditional Japanese woman type

■ Seeks balance and stability, does not make impulse purchases

| I tend to save money for the future. | 88.7%, [78.3%], (56.3%) |

| I seek stability. | 72.6%, [59.2%] |

| I tend to make impulse purchases. | 11.3%, [41.4%], (44.2%) |

■ Wears minimum makeup, bought at the drugstore

| I tend to be careful about skin care. | 35.5%, [68.3%], (65.1%) |

■ Doesn't spend much money, but is keen on education

| I don't mind spending money on education. | 61.3%, [74.8%], (45.0%) |

■ Prefers Japan and Japanese culture

| I prefer foreign brands to Japanese brands. | 3.2%, [48.2%], (24.6%) |

| I like Japanese culture. | 62.9%, [54.0%] |

■ Ideal personal image

| Refined | 24.4%, [32.0%], (11.3%) |

| Sincere | 24.4%, [12.6%], (8.9%) |

| Reliable | 19.4%, [17.8%], (32.1%) |

| Note: | Figures in brackets represent the average derived from this survey, while figures in parentheses are the average for ordinary women from the d-camp X survey |

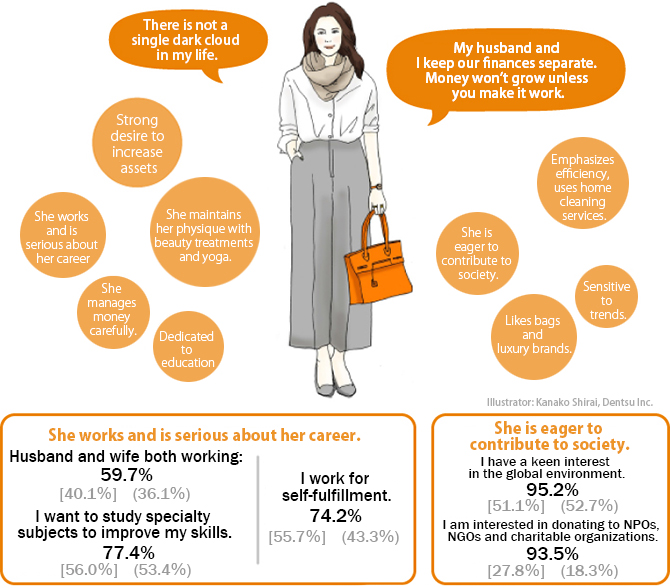

2. The all-out, enjoy-life-to-the-fullest type

She devotes herself completely, both to work and her private life. She sees life as a one-time chance, with no need for compromises, and as something to be enjoyed.

Many affluent women of this type are self-reliant, earning money for themselves, without relying on parents or spouse. She uses the money she earns to enjoy her life. She and her husband keep their finances separate. She is proactive about many things, including work, hobbies, travel, fashion and investing, and loves brand goods. She goes all-out in life.

This is the most common type of woman in terms of sensitivity to trends and confidence about fashion. A strong interest in social contribution is also characteristic of this type, with more than 90% interested in environmental issues, NPOs and charities, and having their own reusable shopping bags.

While all five types of women are positive about education, this type has the most interest. She wants to expand her children's potential, and since her parents were also zealous about education, she feels that this is what she should do for her children. She is a positive and active woman.

Characteristics of the all-out, enjoy-life-to-the-fullest type

■ Most dedicated to education among the affluent segment

| I do not mind spending money on education. | 91.9%, [74.8%], (45.0%) |

■ Strong desire to increase assets

| I am interested in investment. | 71.0%, [61.5%], (25.5%) |

■ Sensitive to trends, and confident about fashion

| I am sensitive to trends. | 64.5%, [46.8%], (31.1%) |

| I am confident about my fashion sense. | 69.4%, [49.8%], (27.5%) |

■ Likes jewelry and luxury brands, especially bags

| I have luxury-brand bags. | 79.0%, [69.9%], (57.5%) |

| I have luxury-brand jewelry and accessories. | 67.7%, [57.0%], (35.0%) |

■ Ideal personal image

| Intelligent | 32.3%, [22.3%], (9.1%) |

| Refined | 30.6%, [32.0%], (11.3%) |

| Kind | 24.2%, [16.5%], (18.0%) |

| Note: | Figures in brackets represent the average derived from this survey, while figures in parentheses are the average for ordinary women from the d-camp X survey |

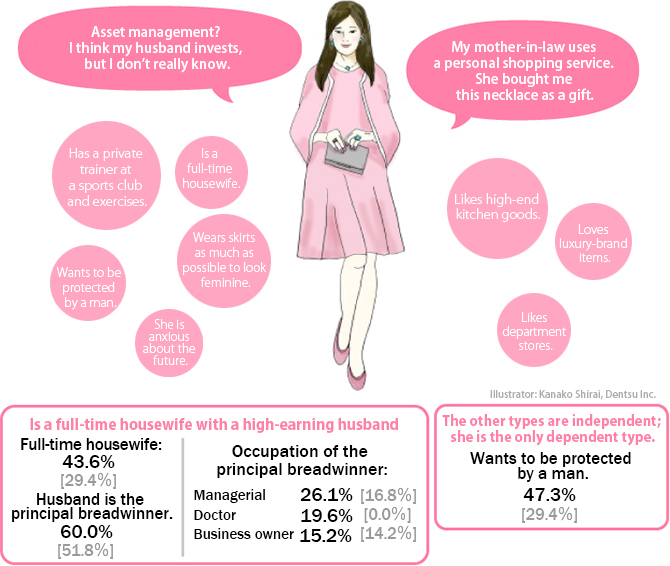

3. The gentle sheltered type

A socialite wife who is sheltered by her elite husband, she relishes being happy. She is not independent, and so has concerns about the future.

This type of woman accounts for the highest proportion of homemakers. Often in the F2 demographic (women aged 35-49), she is generally the wife of an affluent man, who is a corporate manager or doctor. This type of woman has the greatest need "to be protected by a man."

While prioritizing her children, she also enjoys doing things she likes, including spending money on travel, beauty treatments, fashion and brand goods. This type also leads the five categories in terms of use of out-of-store personal shopping services, owning luxury-brand jewelry and watches and enjoying a privileged social status.

Her values and decision-making reflect the views of her husband and, since her lifestyle depends on her husband, she is anxious about the future.

Characteristics of the gentle sheltered type

■ Many concerns

| I worry about caring for my parents in the future. | 56.4%, [33.7%] |

| I worry about my old age. | 52.7%, [31.1%] |

■ Loves department stores; buys cosmetics there

| I use an out-of-store personal shopping service. | 25.5%, [17.8%] |

■ Loves luxury goods

| I have luxury-brand jewelry and accessories. | 94.5%, [57.0%], (35.0%) |

| I have a luxury-brand watch. | 85.5%, [60.2%], (29.2%) |

| I want to wear things that convey a privileged status. | 56.4%, [39.5%] |

■ Ideal personal image

| Refined | 34.5%, [32.0%], (11.3%) |

| Feminine | 25.5%, [13.9%], (6.3%) |

| Having good taste | 21.8%, [11.7%], (12.7%) |

| Note: | Figures in brackets represent the average derived from this survey, while figures in parentheses are the average for ordinary women from the d-camp X survey |

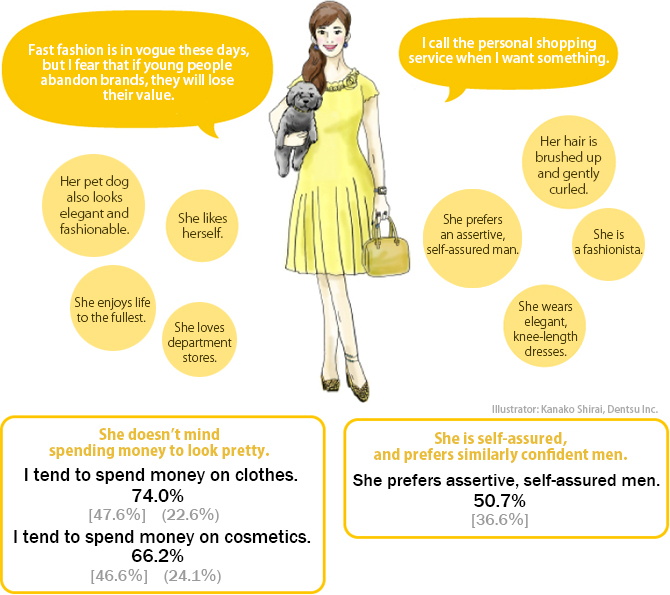

4. The glitzy, fashionista type

She loves to see herself shine and is dedicated to work for self-fulfillment.

This type of woman is the most smartly dressed and self-confident among the members of the five types, and follows fads. Evenly represented in all generations, most of the young women of this type are in the F1 category (women aged 20-34). She spends money mostly on clothes and cosmetics, likes foreign brands, and uses out-of-store personal shopping services.

She loves items that need to be specially ordered. She prefers assertive, self-assured men. She believes that being greedy is unrefined, and wants to be seen as refined and elegant. She enjoys work, and moves easily between office and personal modes. She works hard for her own benefit, and in her private life seeks an enjoyable, flamboyant lifestyle.

Characteristics of the glitzy, fashionista type

■ Enjoys life to the fullest

| I dress fashionably, to adjust my attitude for work and for my personal life. |

90.9%, [71.2%], (60.0%) |

| I use money to enjoy my life today. | 79.2%, [63.4%], (63.4%) |

■ Loves department stores, and buys cosmetics there

| I use an out-of-store personal shopping service. | 23.4%, [17.8%] |

■ Likes herself

| I take pride in my work. | 72.7%, [59.5%], (50.9%) |

| I am confident. | 41.6%, [28.8%] |

■ Trend-conscious

| I prefer foreign brands to Japanese brands. | 70.1%, [48.2%], (24.6%) |

| I am sensitive to trends. | 64.5%, [46.6%], (31.1%) |

| I sometimes want items worn by models or celebrities. | 41.6%, [28.5%], (25.0%) |

■ Ideal personal image

| Refined | 44.2%, [32.0%], (11.3%) |

| Elegant | 20.8%, [11.3%] |

| Fashionable | 18.2%, [9.7%], (6.4%) |

| Note: | Figures in brackets represent the average derived from this survey, while figures in parentheses are the average for ordinary women from the d-camp X survey |

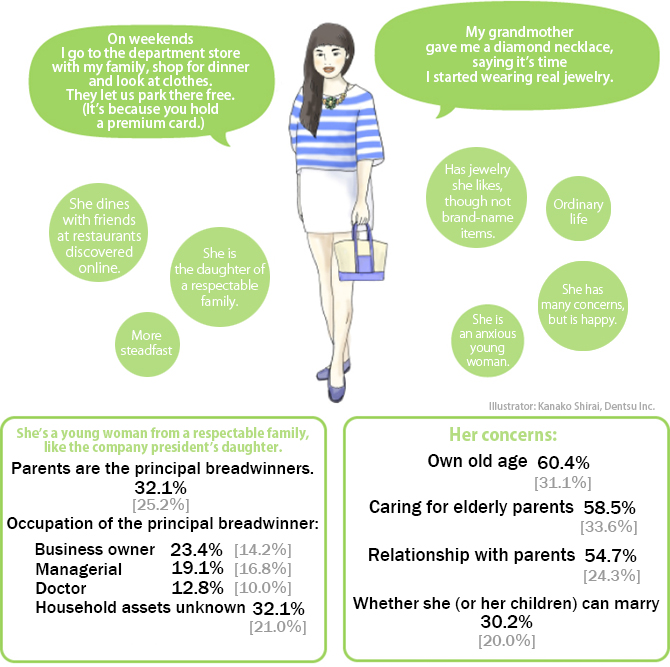

5. The unaware hidden type

She is indifferent to her wealth and her good upbringing shows through.

Many such women are young and unmarried, and the most likely to live at home. She has a fair idea of their annual income, but knows little about the family assets.

Her sense regarding money matters is close to that of ordinary women. She doesn't normally wear luxury brands, and regularly uses point cards and coupons when shopping. Although her parents are wealthy she was raised well, and so has the values of an ordinary woman her age. She is somewhat out of touch with worldly matters, not realizing that the store cards her family uses are premium, special customer cards. She gives the impression of a well-bred daughter, raised by education-minded parents.

This type typically has many concerns about the future. She would like a romance but is happy with the life she has, while realizing that she'll never marry unless she makes an effort. She worries about caring for her parents and even herself in old age. There is no end to her troubles.

Characteristics of the unaware hidden type

■ More steadfast than ordinary women

| I tend to shop at stores where I have a point card. | 88.7%, [81.6%], (86.4%) |

| I often use coupons and discount tickets when shopping. | 71.7%, [61.5%], (35.0%) |

■ Not unusual for a woman her age

| I have luxury-brand jewelry and accessories. | 35.8%, [57.0%], (35.0%) |

■ Ideal personal image

| Knowledgeable | 24.5%, [22.3%], (9.1%) |

| Refined | 22.6%, [32.0%], (11.3%) |

| Sincere | 17.0%, [12.6%], (8.9%) |

| Note: | Figures in brackets represent the average derived from this survey, while figures in parentheses are the average for ordinary women from the d-camp X survey |

In our next installment, we feature a dialog with Ms. Hiromi Sogo, editor-in-chief of Hearst Fujingaho's 25ans and Richesse, who has a good understanding of the affluent women segment.

Notes

- Overview of the affluent segment survey

- Qualitative research

Method: Internet survey Period: February 25‒27, 2015 Coverage: 309 women throughout Japan aged 20‒60, with household assets of at least ¥100 million (approx. US$880,000), or an annual household income of at least ¥20 million (approx. US$176,000) Executing agency: Planning: Dentsu, Hearst Fujingaho; Execution: Dentsu Macromill Insight - Qualitative research

Method: In-depth interviews, home visits Period: April 8‒26, 2015 Coverage: Thirteen women with the characteristics of the five clusters Region: Kanto, Kansai areas Executing agency: Planning: Dentsu, Hearst Fujingaho; Execution: Dentsu Macromill Insight

- Qualitative research

- Reference scores for ordinary women (overview of the Dentsu d-camp)

Method: Electronic questionnaire conducted by lending a special-purpose tablet Period: September 2014‒March 2015 Coverage: Approx. 4,800 samples (random sampling) from men and women aged 12‒69, living within 50 km of Tokyo (2,749 selected as ordinary women aged 20‒69, to compare with affluent women) Executing agency: Planning: Dentsu, Hearst Fujingaho; Execution: Dentsu Macromill Insight

Project members

Kaori Ishii

Chief Planner

Integrated Digital Marketing Division

Dentsu Inc.