--In 2020, Advertising Expenditures in Japan Amounted to 6,159.4 Billion Yen (Down 11.2% Year on Year), Reflecting the Impact of the Global COVID-19 Pandemic; This Marked the First Market Contraction in Nine Years, Since the Great East Japan Earthquake in 2011, and a Margin of Decrease Second Only to That Following the Global Financial Crisis in 2009; Expenditures on Internet Advertising Continued to Grow, Driven by Japanese Society's Accelerating Digital Transformation--

Dentsu Inc. (Headquarters: Minato-ku, Tokyo; President & CEO: Hiroshi Igarashi) today released its calendar year 2020 annual report on advertising expenditures in Japan, including an estimated breakdown by medium and industry.

In 2020, Japan's advertising expenditures substantially decreased, particularly for the April-June quarter. This reflected the impact of the global COVID-19 pandemic, which saw the postponement or cancellation of a wide range of events, advertising campaigns, and sales promotion campaigns. Signs of a gradual recovery appeared starting in July. In the October-December quarter, expenditures were recovering to a level on a par with the corresponding quarter of 2019. However, on a full-year basis advertising expenditures totaled 6,159.4 billion yen, an 11.2% decrease compared with the previous year. This marked the first annual decline in total advertising expenditures in nine years, the previous occasion having been in the aftermath of the Great East Japan Earthquake and Tsunami of 2011. The margin of decrease is second only to that recorded in 2009 (down 11.5%) following the global financial crisis.

Overview of Japanese Advertising Expenditures during 2020

◆In 2020 overall advertising expenditures amounted to 6,159.4 billion yen (down 11.2%). Starting in March, owing to the impact of the COVID-19 pandemic, the movement of people was restricted both in Japan and overseas. Following the declaration of a state of emergency in Japan in April, the Japanese economy experienced a significant slowdown. Consumption generated by the inbound visitor market--a key driver in recent years--came to a virtual standstill. People were urged to stay at home, which had a major negative impact on many sectors. Food services, transportation and leisure in particular were severely affected. The advertising industry was also buffeted by the after-effects of these conditions. As the central government and local governments moved to implement economic policies to deal with the pandemic, and measures were put in place to control the spread of COVID-19, signs of gradual recovery began to appear starting in July. In the October-December quarter, expenditures were returning to levels on a par with the corresponding quarter of 2019. However, over the year as a whole, advertising expenditures were significantly lower compared with the previous year.

◆For the first time in nine years--since the aftermath of the 2011 Great East Japan Earthquake and Tsunami--annual advertising expenditures shrank. It was also the first year a double-digit rate of contraction was recorded since the recession in 2009, triggered by the global financial crisis. The rate of decline was the second highest of any year since Dentsu began compiling estimates in 1947.

◆As large numbers of people refrained from going out or traveling, there was a surge in demand related to staying at home, and the digital transformation (DX) of social life greatly accelerated. This was particularly evident in such fields as delivery services, online shopping, online conferencing, online events and seminars, remote working, and cashless payment services. Driven by this trend, Internet advertising expenditures took the lead in staging a recovery, and achieved growth on a full-year basis. Expenditures on digital advertising carried by traditional media companies maintained the double-digit growth seen in the previous year. For advertising and sales promotion campaigns originating in digital media, 2020 was a year of further evolution and growth. In contrast, promotional media spending was substantially lower owing to the impact of the COVID-19 pandemic, which led to the postponement or cancellation of a broad range of events, exhibitions, and conventional advertising and sales promotion campaigns. This included the postponement of the 2020 Tokyo Olympic and Paralympic Games. In traditional media, which run advertising campaigns concomitant with events, advertising expenditure declined significantly.

Overview of Advertising Expenditures by Medium

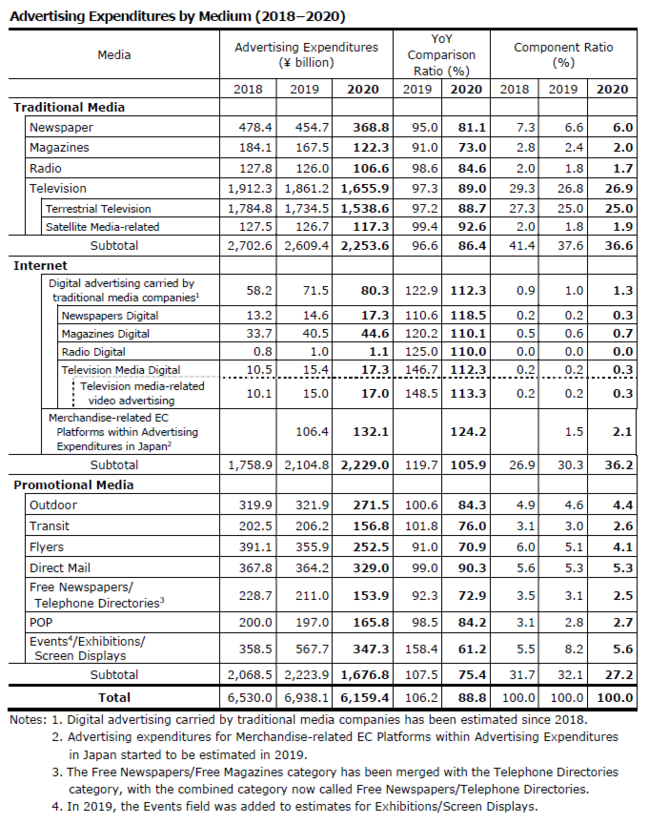

Broken down by medium, Advertising Expenditures in Japan are classified into three broad areas: (1) traditional media advertising expenditures; (2) Internet advertising expenditures; and (3) promotional media advertising expenditures. In 2020, accompanying the postponement or cancellation of events and sales promotion campaigns, there were large decreases in traditional media and promotional media advertising expenditures. Consequently, total advertising expenditures declined.

(1) Traditional media advertising expenditures amounted to 2,253.6 billion yen (down 13.6%)

Traditional media expenditures recorded their sixth consecutive year of decline. Newspaper, magazine, radio and television advertising expenditures all shrank compared with the previous year.

(2) Internet advertising expenditures amounted to 2,229.0 billion yen (up 5.9%)

Internet advertising expenditures have consistently grown every year since Dentsu began compiling estimates of this medium in 1996. In 2020, the scale of the Internet advertising market exceeded 2.2 trillion yen--a level commensurate with the overall size of the traditional media market. Although Internet advertising expenditures felt the impact of the COVID-19 pandemic in the April-June quarter, over the year as a whole e-commerce (including live-streaming e-commerce) was robust. Expenditures on digital advertising carried by traditional media companies amounted to 80.3 billion yen (up 12.3%), while advertising expenditures for Merchandise-related EC Platforms within Advertising Expenditures in Japan* amounted to 132.1 billion yen (up 24.2%). The double-digit growth rates of these categories further drove growth in Internet advertising as a whole.

* Advertising expenditures for Merchandise-related EC Platforms within Advertising Expenditures in Japan only include advertisers with stores and advertising transactions carried out by those advertisers for products on merchandise-related EC platforms such as household appliances, miscellaneous goods, books, clothing, and office supplies. Those expenditures do not comprise the overall Internet advertising expenditures in the EC platforms category.

#####

The full text of 2020 Advertising Expenditures in Japan is currently being compiled and will be available on Dentsu's website at the end of April 2021. For reference, please refer to the tables on the following pages.

Contact

Media-related inquiries: Corporate Communications Division