-Total advertising expenditures in Japan grew 4.4% year on year to a record-high of 7,102.1 billion yen; Internet advertising expenditures surpassed 3 trillion yen, driving the growth in the advertising market as a whole; Television Media-related Video Advertising expenditures jumped 40.6% compared with the previous year-

Dentsu Inc. (President & CEO: Norihiro Kuretani; Head Office: Tokyo), today announced the completion of its calendar year 2022 annual report on advertising expenditures in Japan, which includes a breakdown of estimated expenditures by advertising medium and industry.

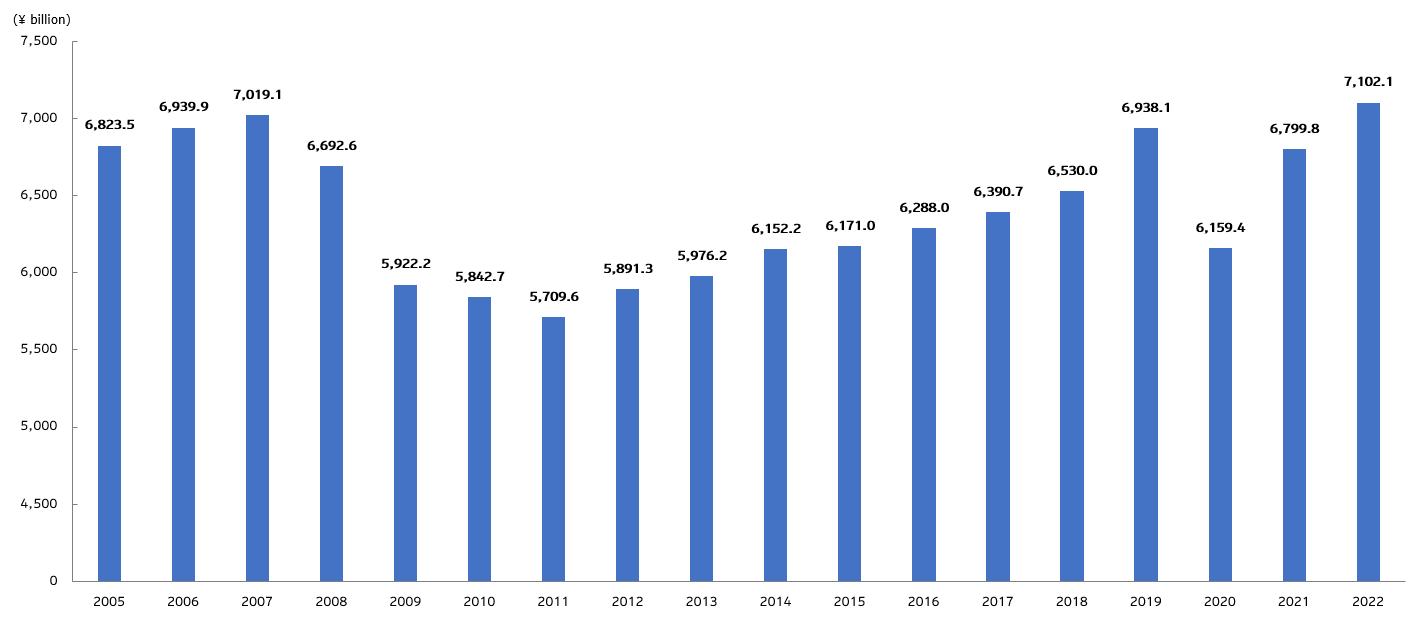

While impacted by various domestic and international factors, including the rebound in COVID-19 infections in Japan, the war in Ukraine, and steeply rising commodity prices, total advertising expenditures in Japan increased 4.4% year on year to 7,102.1 billion yen in 2022, since the market as a whole was backed by growth in Internet advertising expenditures, reflecting the ongoing digital transformation of Japanese society.

Advertising Expenditures in Japan

Note: The method for estimating advertising expenditures was revised in 2007. The categories of Events and Merchandise-related EC Platforms within Advertising Expenditures in Japan were added in 2019. Results up to 2018 have not been adjusted to reflect this change.

Overview of Japanese Advertising Expenditures during 2022

◆In 2022, total advertising expenditures grew 4.4% year on year to 7,102.1 billion yen, not only surpassing the pre-pandemic total in 2019, but also reaching a record-high since these expenditures were first estimated in 1947*. In the first half of the year, advertising expenditures were robust due to the easing of COVID-19 restrictions and the impact of the Beijing 2022 Winter Olympic and Paralympic Games. In the second half of the year, despite major economic changes resulting from the war in Ukraine and monetary policy reversals in the United States and Europe, as well as new waves of COVID-19 cases, a gradual pickup in economic activity in Japan boosted advertising demand, particularly advertising related to restaurants and services, as well as transportation and leisure. As a whole, Japan's advertising market grew on the back of rising Internet advertising expenditures, which reflected the ongoing digital transformation of Japanese society.

* The previous record was 7,019.1 billion yen in 2007.

◆Internet advertising expenditures rose 14.3% year on year to 3,091.2 billion yen, marking an increase of around 1 trillion yen over just three years since the amount surpassed the 2 trillion-yen mark in 2019. Demand for video ads, particularly in-stream ads, has continued to rise since 2021, and growth in digital promotions contributed to market expansion. The overall increase in total advertising expenditures in 2022 was mainly driven by the solid growth in Internet advertising expenditures.

◆Television Media-related Video Advertising expenditures jumped 40.6% year on year to 35.0 billion yen. These Internet expenditures comprise video streaming-type media, including catch-up TV services and simulcast services, and fall under the broader category of Television Media Digital, which includes expenditures for digital ad space primarily offered by television media companies. The growing demand for this advertising reflected the widespread popularity of connected TVs* and higher production standards of programs offered, including popular dramas and live streaming of major sporting events.

* Televisions that can connect to the Internet

Overview of Advertising Expenditures by Medium

In Dentsu Inc.'s annual reports on advertising expenditures in Japan, expenditures are classified into three broad areas of advertising media: (1) Traditional Media advertising expenditures (comprising advertising expenditures and their respective production costs for the categories of Newspapers, Magazines, Radio, and Television); (2) Internet advertising expenditures (comprising the categories of Internet Media costs, Merchandise-related EC Platforms within Advertising Expenditures in Japan, and Internet advertising production costs); and (3) Promotional Media advertising expenditures (comprising advertising expenditures for the categories of Outdoor, Transit, Flyers, Direct Mail, Free Newspapers, POP, and Events/Exhibitions/Screen Displays).

(1) Traditional Media advertising expenditures amounted to 2,398.5 billion yen (down 2.3%)

Despite an increase in the category of Radio advertising expenditures, Newspapers, Magazines, and Television advertising expenditures decreased compared with the previous year.

(2) Internet advertising expenditures amounted to 3,091.2 billion yen (up 14.3%)

Reflecting the ongoing digital transformation across Japanese society, Internet advertising expenditures (comprising the categories of Internet Media costs, Merchandise-related EC Platforms within Advertising Expenditures in Japan, and Internet advertising production costs) increased 14.3% year on year and accounted for 43.5% of total advertising expenditures. Since surpassing the 2 trillion-yen mark in 2019, this market has grown by about 1 trillion yen over the past three years to more than 3 trillion yen. Of the total, Internet Media costs amounted to 2,480.1 billion yen, up 15.0%. Television Media-related Video Advertising expenditures, in particular, rose 40.6% to 35.0 billion yen, reflecting the widespread popularity of connected TVs. Internet advertising production costs increased 9.2% to 420.3 billion yen, mainly due to growth in the video advertising market and a greater number of performance-based advertising campaigns. Advertising expenditures for Merchandise-related EC Platforms within Advertising Expenditures in Japan* increased 17.0% to 190.8 billion yen as household demand continued to rise.

* Advertising expenditures for Merchandise-related EC Platforms within Advertising Expenditures in Japan are limited to expenditures for advertising on e-commerce platforms that sell such merchandise as household appliances, miscellaneous goods, books, clothing, and office supplies, incurred by operators of stores that use these platforms to sell goods. Accordingly, these expenditures do not cover the total amount of Internet advertising expenditures for advertising products sold through e-commerce as a whole.

(3) Promotional Media advertising expenditures totaled 1,612.4 billion yen (down 1.7%)

Despite the easing of COVID-19 restrictions, resumption of various events and conventional advertising campaigns, and implementation of domestic travel subsidy programs by the national and municipal governments, Promotional Media advertising expenditures decreased on the whole during 2022. Nevertheless, expenditures increased year on year in the categories of Outdoor, Transit, and Flyers, as the movement of people began returning to normal.

TABLE 1

Advertising Expenditures by Medium (2020−2022)

TABLE 2

Sources of Media Expenditures

TABLE 3

Advertising Expenditures and Japan's Nominal GDP (2001−2022)

Notes:

1. The GDP figures are taken from the Cabinet Office's "Annual Report on National Accounts" and "Quarterly Estimates of GDP."

2. The method for estimating advertising expenditures in Japan was modified in 2007, and the data for 2005 and 2006 have been retroactively revised.

3. Since 2018, digital advertising carried by traditional media companies has been added to estimates for Internet Advertising Expenditures.

4. Since 2019, advertising expenditures for Merchandise-related EC Platforms within Advertising Expenditures in Japan have been added to estimates for Internet Advertising Expenditures, and Events advertising expenditures have been added to estimates for Exhibitions/Screen Displays.

TABLE 4

Advertising Expenditures by Industry in Traditional Media for 2022

(Traditional Media Only, Excluding Satellite Media-related Spending)

#####

Contact

Media-related inquiries:

Corporate Communications Office, Dentsu Corporate One Inc.

Email: global.communications@dentsu.co.jp